Digital Banking – Vision 2024

Mobile banking app research

Mobile banking is a promising new direction for banking system operations worldwide. While drawing up this digital banking report, Andersen’s experts analyzed the most popular mobile banking apps, their advantages, and their disadvantages. Examining the market landscape as a whole, as well as statistics on mobile banking usage, our team scrutinized end-users and important business components.

Industry market size

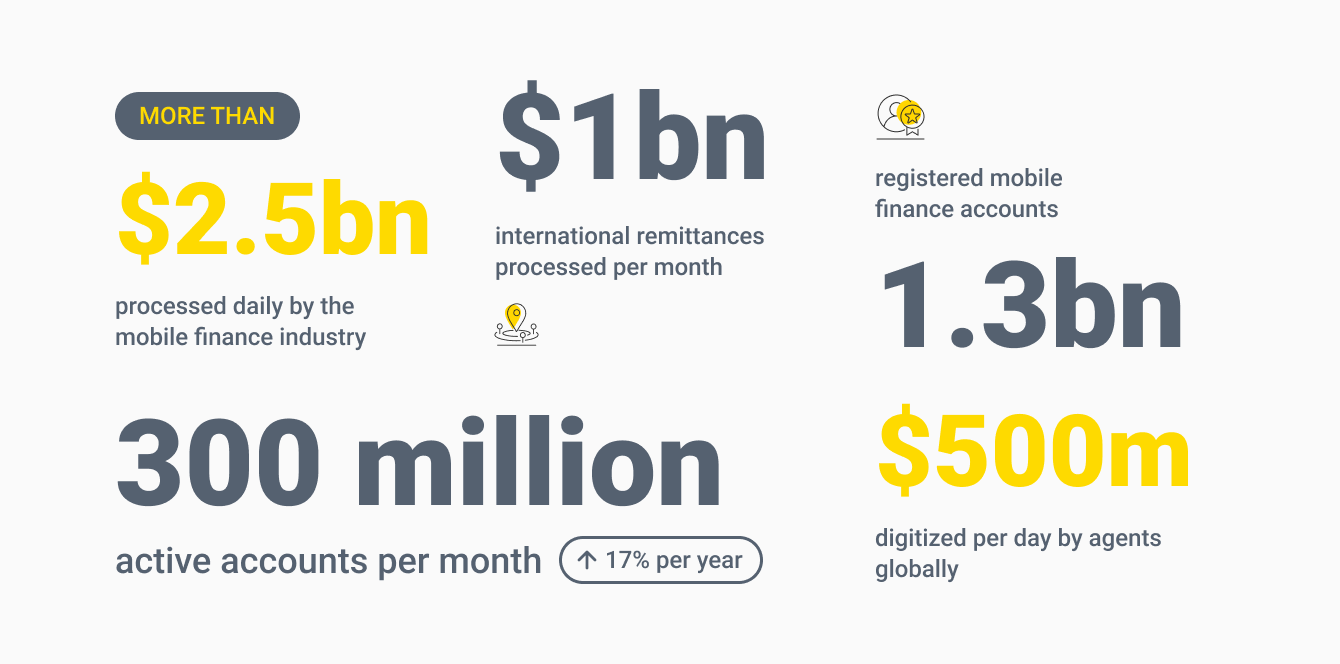

With 5.3 billion mobile users worldwide, the potential of the mobile industry, in terms of its reach and innovation, is sufficient to promote further financial inclusion and build more equitable societies. As of now, every month there are over 300 million active mobile finance accounts. Not only are customers using their accounts more frequently, but they are also applying them to new and more advanced use cases. That suggests that more and more people are moving away from the margins of financial systems and living increasingly digitized lives.

Mobile banking in numbers

As more and more consumers feel uncomfortable while handling cash, many users turn to mobile finance to purchase food, clothing, and other essential products and services. That undoubtedly contributed to an upsurge in merchant e-payments. The value of mobile merchant payments grew by 47 percent compared to 28 percent last year. Transaction values also increased across the board, as more money circulated and was cashed-in and cashed-out than ever before. For the first time, the global value of daily transactions exceeded 2.5 billion dollars, and it is expected to surpass $3 billion a day by the end of 2022:

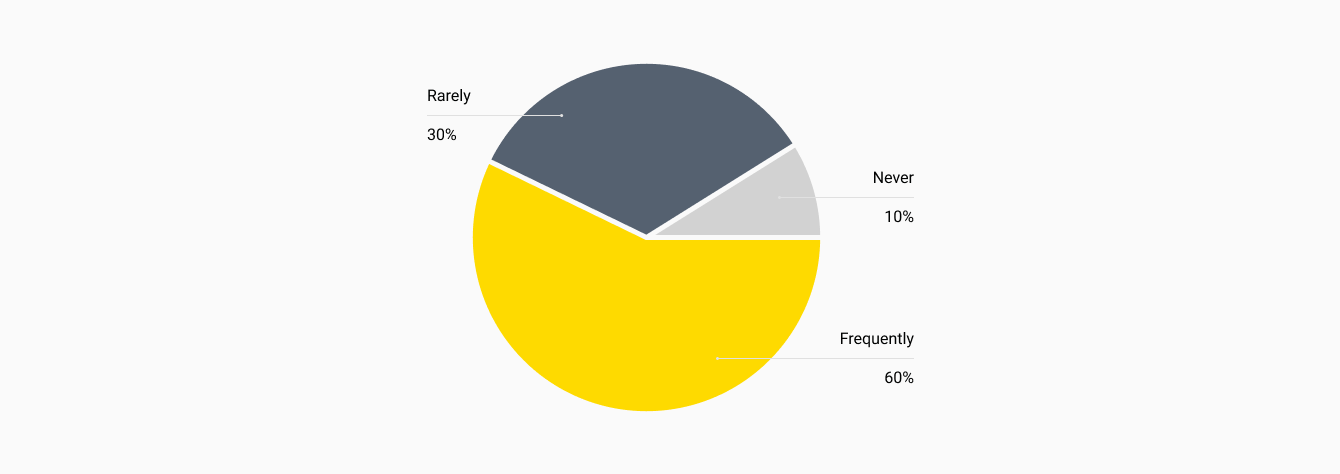

Mobile platforms

In 2020, as stated in the above online banking report, the mobile money industry reached another major milestone: the number of monthly active mobile finance accounts topped 300 million, having grown at a rate of 17 percent year on a yearly basis. 64 mobile money providers – roughly one in five – had over one million monthly active accounts. This is up from 30 providers in 2016. This strong and steady growth suggests that customers are using mobile money in more advanced ways and in all aspects of daily life. In contrast, infrequent use may imply that a user is simply a recipient of remittances and not reaping the full benefits of mobile finance. It should be emphasized that even in high-income countries with high levels of banking penetration, individuals can still be financially marginalized. With account registrations likely to plateau in the next decade, it will become even more important to understand how actively and frequently mobile money is used.

Functional limitation

According to various online banking system reports, it is imperative that banks do not develop the UI of mobile banking apps as a copy of their Internet banking sites, as the screens, displayed, network connections, and user attention levels are different from desktop/laptop usage patterns. The accessibility requirements for different age groups and differently-abled people would also be part of the future scope to facilitate the banking mobile app adoption rates.

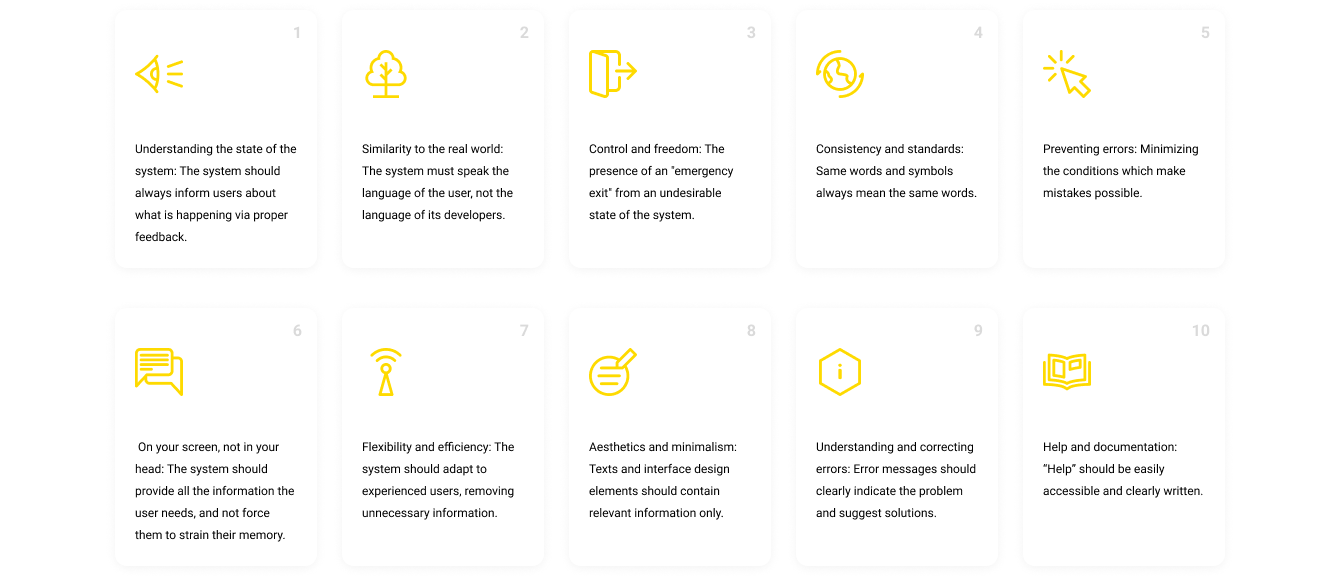

Usability assessment

Andersen’s specialists perform usability assessments based on Nielsen's heuristics. Below you can find the principles by which the research was framed, guided, and done. You can also see the outcomes of our research activities. Improving usability means a constant journey with changing customer experiences and ongoing technology innovation. Hence, as stated in various digital banking market reports, it is recommended for banks to review their usability requirements. Better usability of mobile apps contributes to greater customer loyalty and, therefore, customer's continuous engagement with their banks.

Results

- Quite often, the interface provides enough information to interact with accounts, articles, and other sections of the panel.

- On the separating pages, the following problem is often identified. If some material is located too far away, one needs to search for it manually, and the outcome depends on the user's focus.

- Lists and tables are built conveniently enough so that it does not make the interaction with displayed info complicated.

- Functional pages need to be improved - admins need to be able to interact flexibly and customize the interface.

- A common problem with storytelling is that users can get lost in the flow of information displayed by the page they interact with.

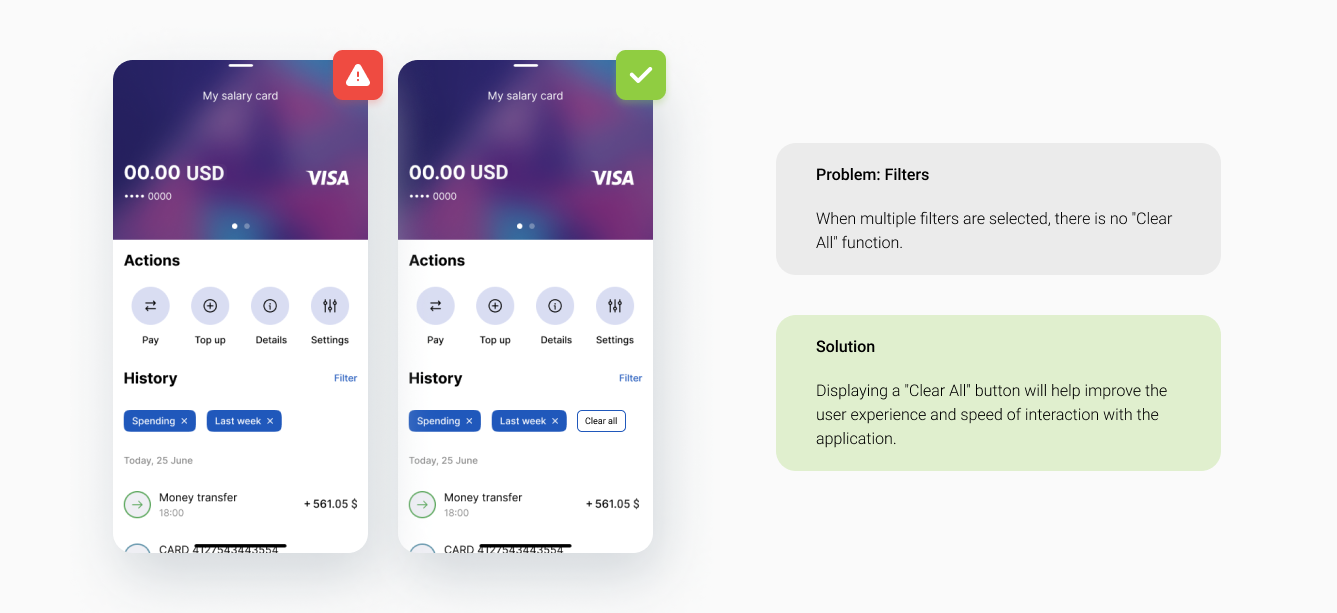

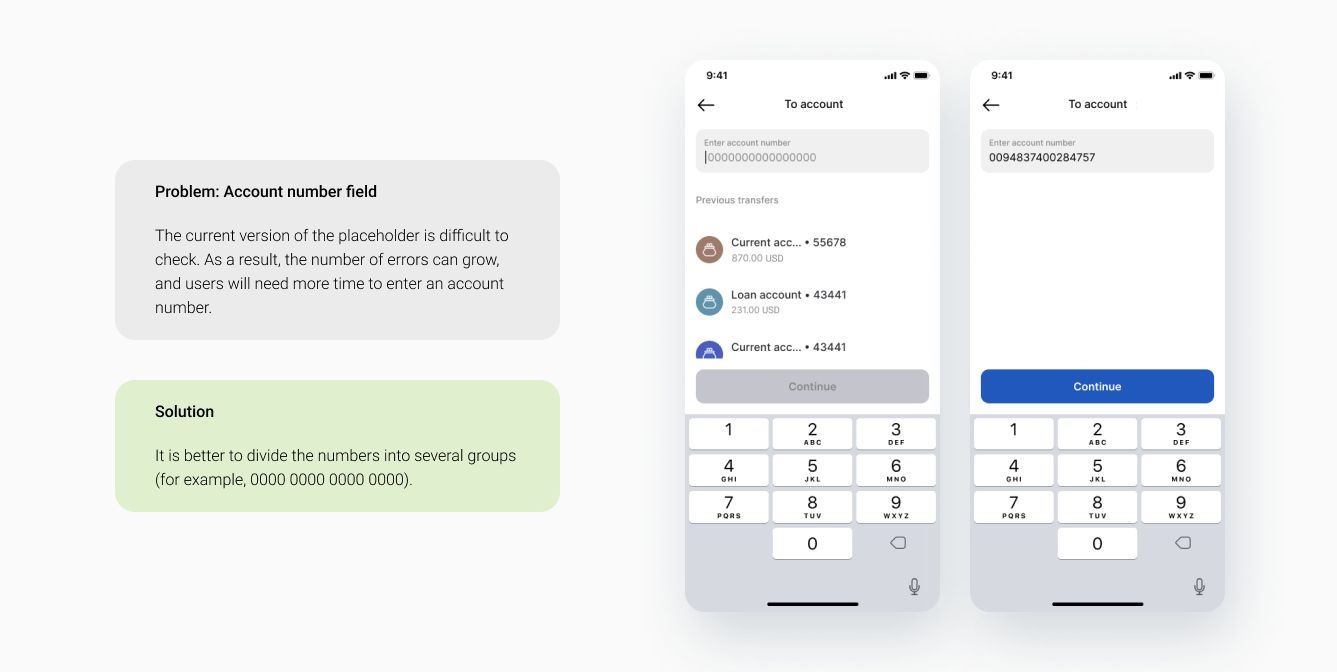

Red points

- The administrator should be able to quickly adapt to the service and get all the necessary information - now this is not possible.

- There should be no 'ghostly errors' - users should always understand what happens, how it happens, and how to fix the problem.

- There are difficulties related to navigation and the transition logic - it is necessary to reconsider the relationship between the pages.

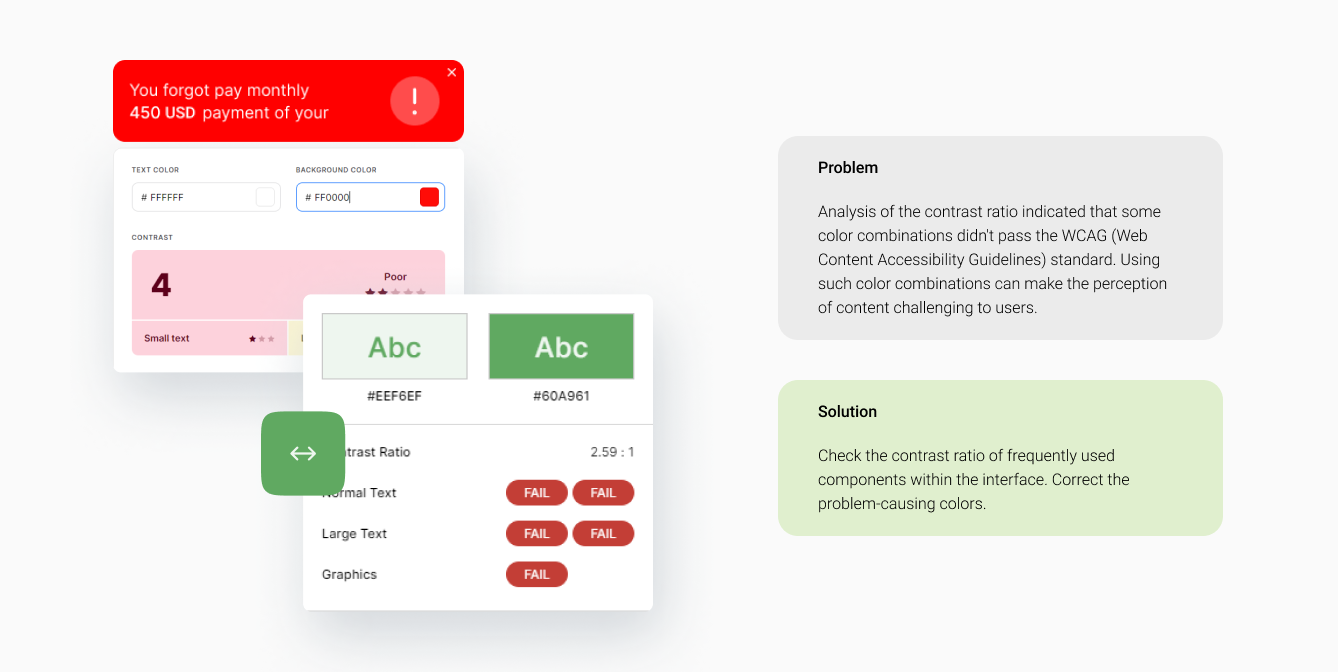

Accessibility

As found out during this digital banking research, mobile devices should consider the entire spectrum of disabilities, i.e. visual, hearing, physical, cognitive, age-based. The challenge of addressing all of those special needs in a device of limited size is aggravated by the breadth of functionalities enabled by mobile phones. Product designers, manufacturers, systems designers, and application developers should be aware of the entire range of user requirements while designing mobile devices and applications.

Benefits of Mobile Banking

In this mobile banking report, Andersen’s experts would like to highlight the following prominent benefits of online finance solutions:

Always on

A mobile phone is always portable due to its inherent design. It allows users to be involved in such activities as traveling and meeting people, as well as to perform transactions as long as the devices has access to the Internet.

Location-centric

Global Positioning System (GPS) can be used to recognize the phone, identify its location, and personalize available options based on the existing services. As a result, a significant advantage is ensured for eCommerce.

Convenience

Time and space do not impose insurmountable limitations on mobile users with access to e-activities. As a result, their quality of life is significantly improved. Hence, the more convenient services are, the more loyal clients are.

Customization

Mobile phones exercise greater influence than PCs. They can ensure a more personalized user experience. Therefore, mobile commerce developers are expected to design more creative and more customized lifestyle tools.

Ability identification

Mobile phones are capable of secure yet convenient and portable e-transactions impossible with PCs. Any person can always use their mobile devices. Hence, the latter are a perfect option for personalized and targeted marketing.

Mobile banking development system

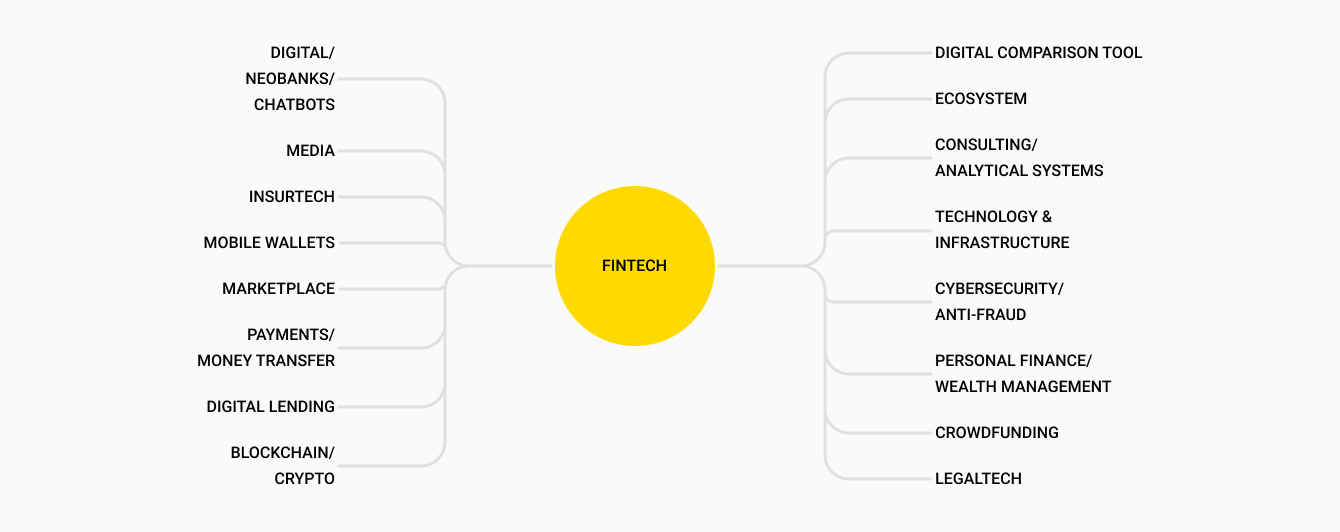

Aspects involved in fintech business development, global directions.

Bank evolution

Traditional banks have been evolving along with technological advancement. Below are the stages demonstrating the evolution process of payment technologies and banking services.

Traditional bank

Banking services.

Marketplace

Both banking and non-banking services.

Ecosystem

Both banking and non-banking services, SSO + white label, payment technologies, interconnections across the entire banking user experience.

Native implementation

Both banking and non-banking services, SSO + white label, payment technologies, interconnections across the entire banking user experience, native integration.

Beyond an Internet-bank

Banking services and non-banking services within the same Internet-bank, sales activities available via external platforms.

Company's portfolio analysis and management

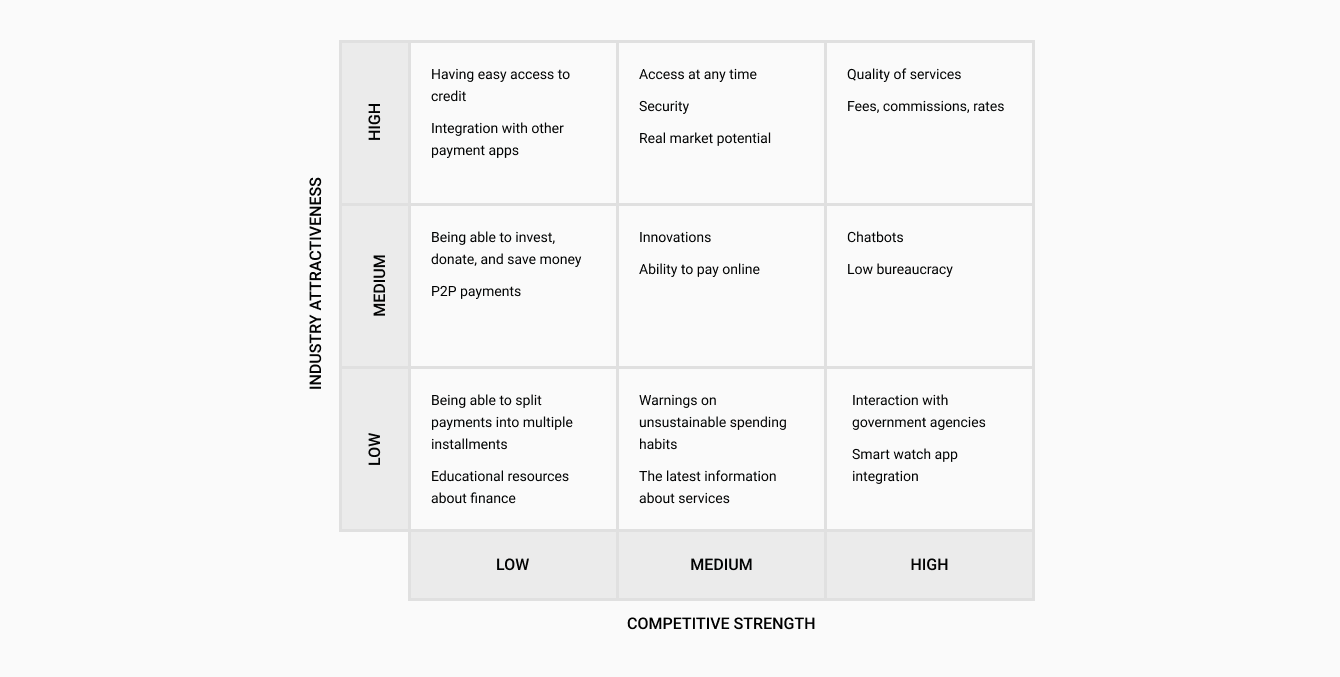

In order to issue this comprehensive digital banking market report, Andersen’s experts decided to identify complex indicators of market attractiveness and competitive statuses. Analysis was carried out based on the GE McKinsey Matrix. Our team assessed the potential of various business directions pursued by the chosen companies and scrutinized the competitiveness of their products in the current market. We also covered the prospects of their products across the new emerging sectors. It all was needed to elaborate a suitable strategy to manage companies’ portfolios that would highlight priority areas for future activities and reduce efforts and investments spent on developing products of little promise.

Competitive analysis

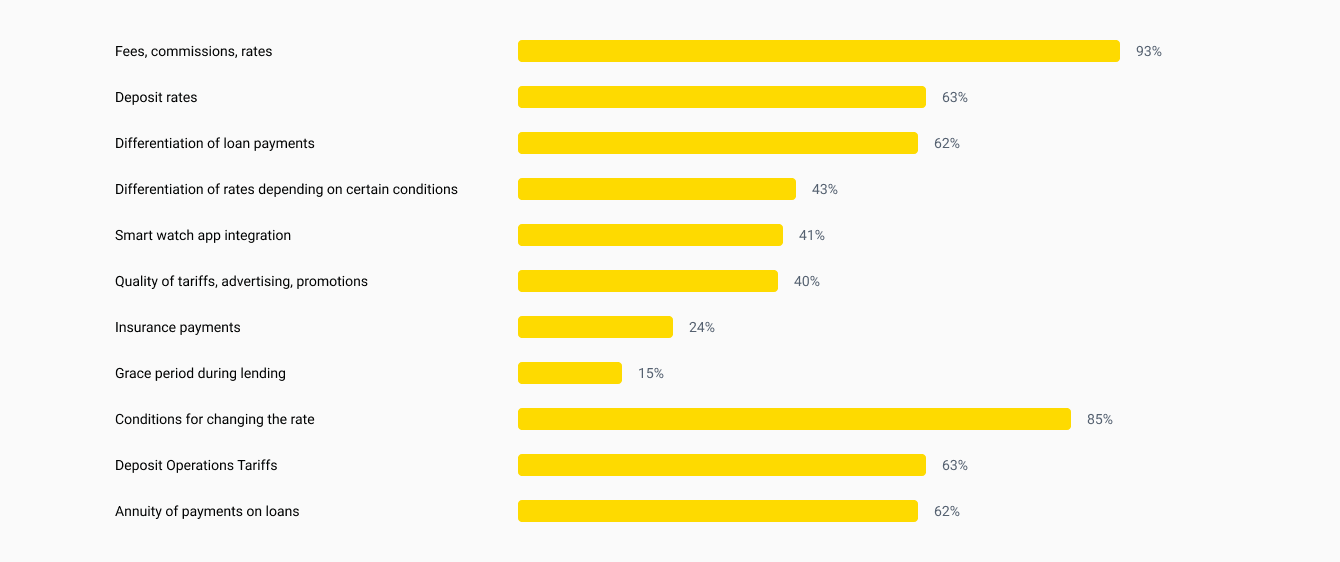

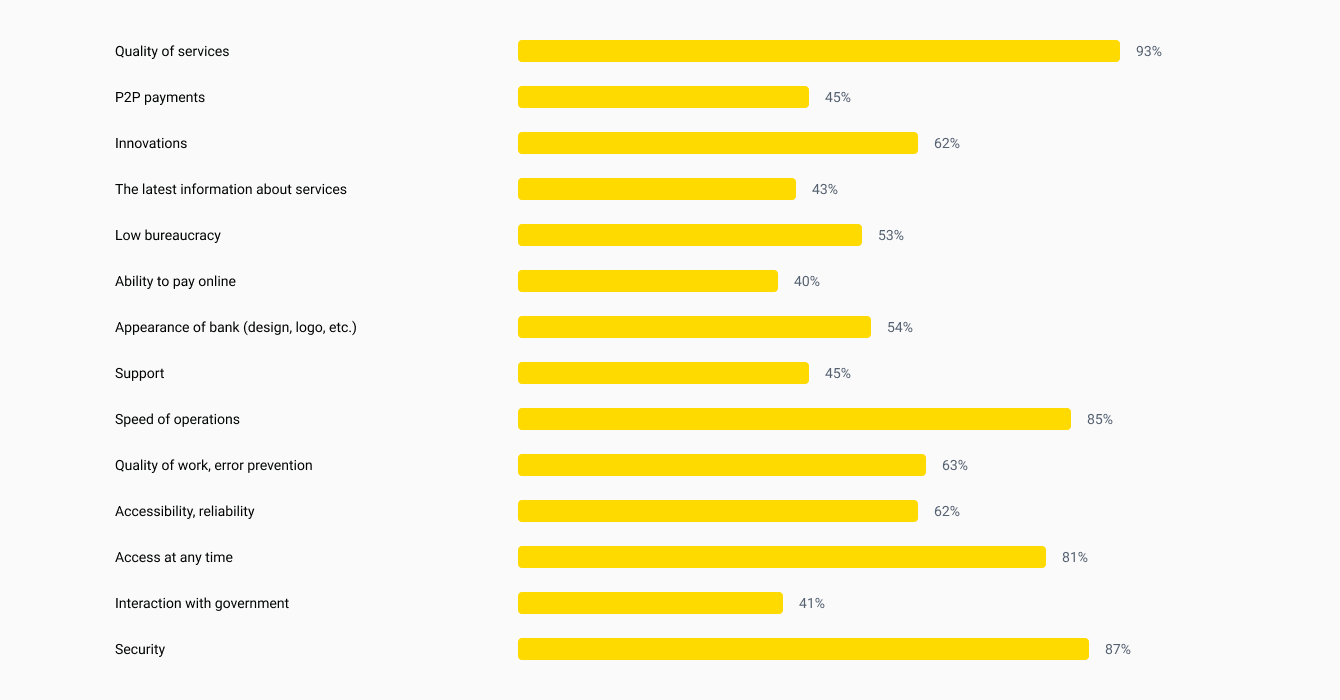

Andersen’s experts carried out a thorough competitive analysis and assessed the importance of each option mobile banks provide to their users. In this online banking report, our team would like to present the final impact of these options on banks’ market standing.

Price factors

Non-price factors

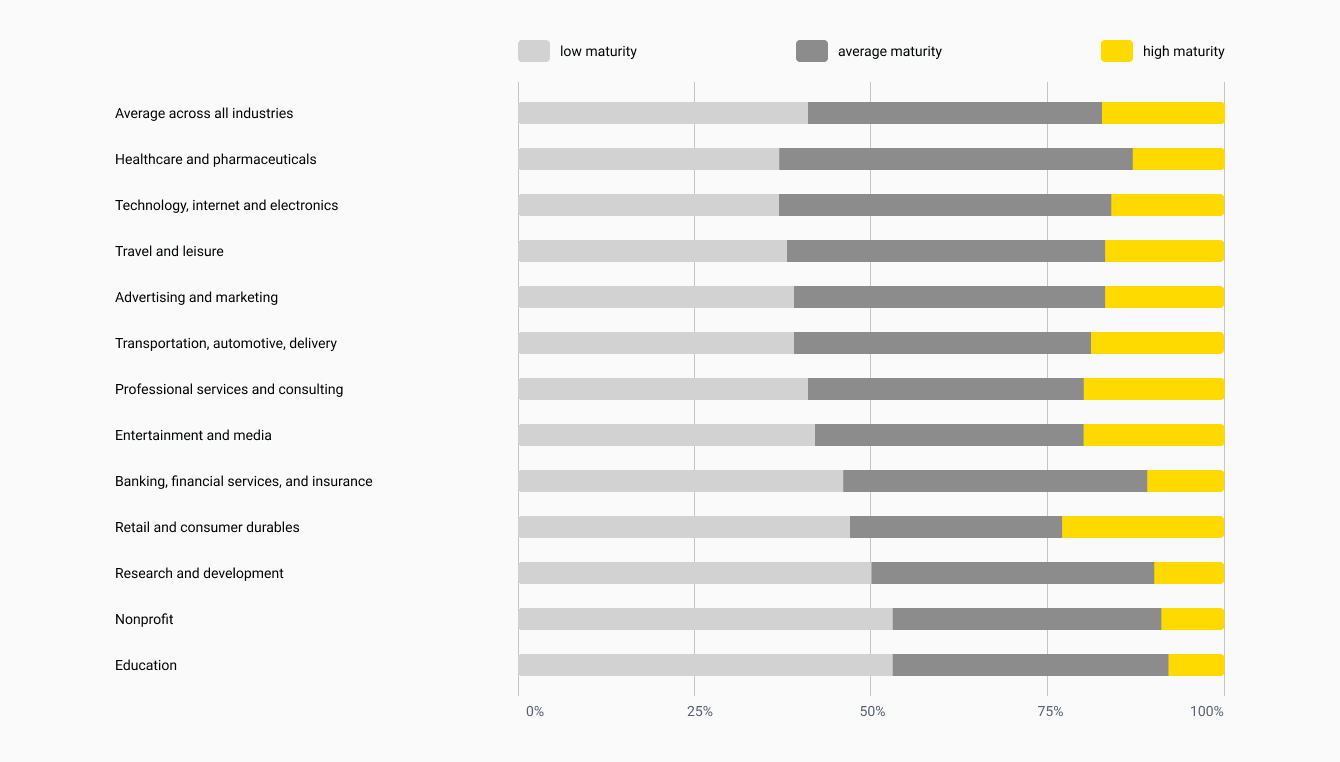

Assessment of market attractiveness

When working on this online banking system report, Andersen’s specialists found out that some industries lean toward lower maturity levels, some tend to have higher than average maturity levels, while some exist somewhere in-between. The leading industries include healthcare, pharma, IT, advertising, transportation, and the automotive sector. These industries have fewer low-maturity companies than on average. Industries with the greatest space and need for improvement include education, non-profit organizations, research & development, retail, consumer durables, and, quite surprisingly, banking. The banking industry is known for its large UX teams, yet it is clearly behind when it comes to design maturity. This is a prime example of how investing in resources generates little effect if it is not accompanied by the incorporation of design into the overall business strategy.

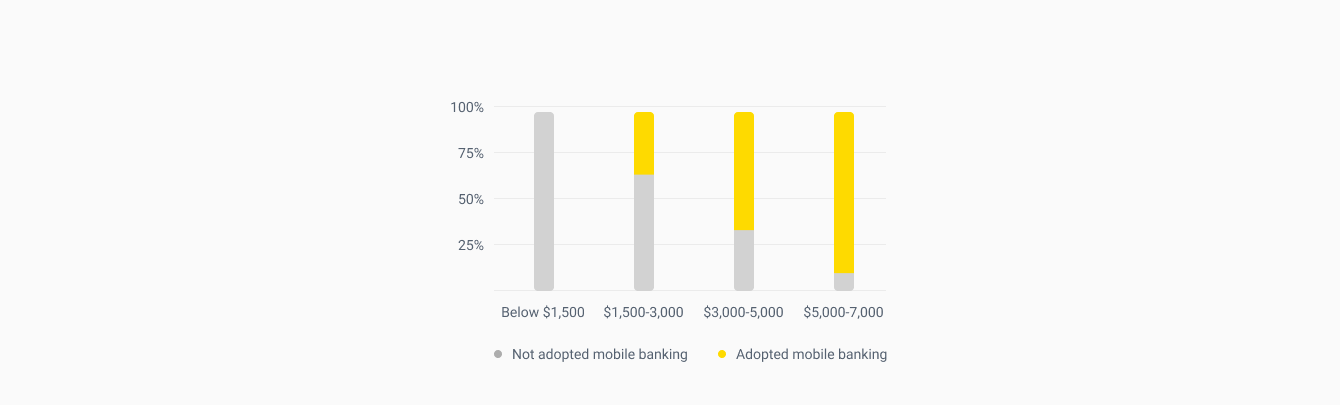

Relationship between mobile banking adoption and income level

When drawing up this mobile banking report, Andersen’s experts analyzed the income growth of individuals over five years and identified how this affected their level of mobile banking adoption. It turned out that mobile banking apps are extremely popular with users with increasing incomes who need to arrange their financial information in a logical order.

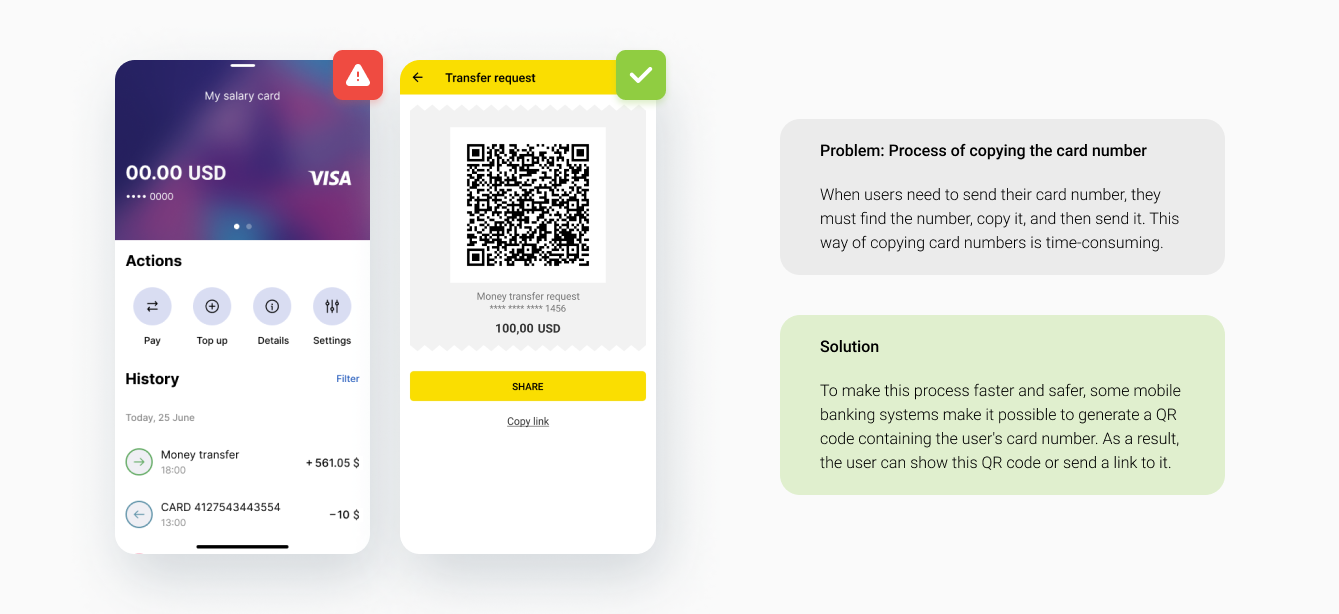

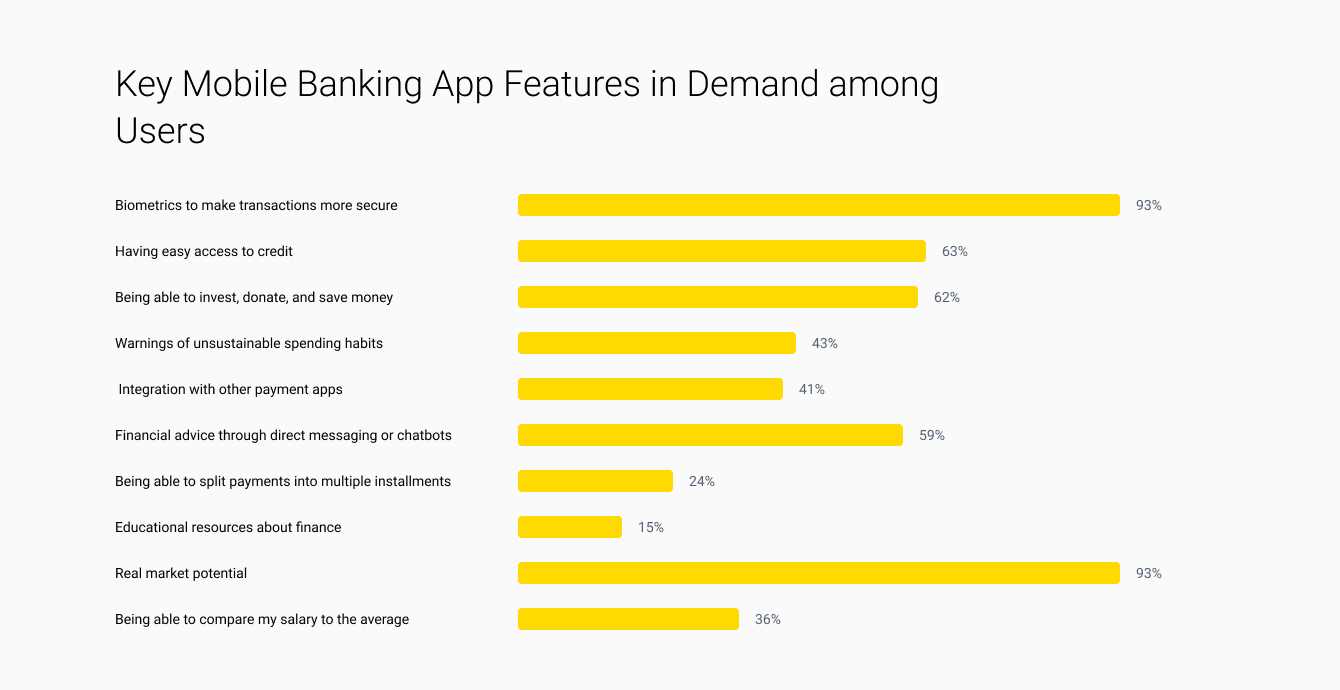

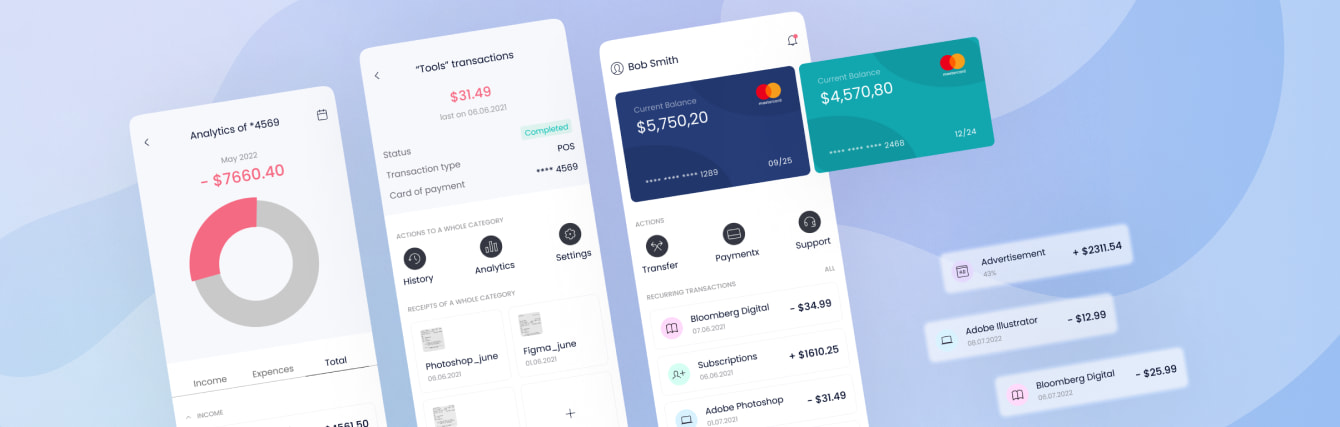

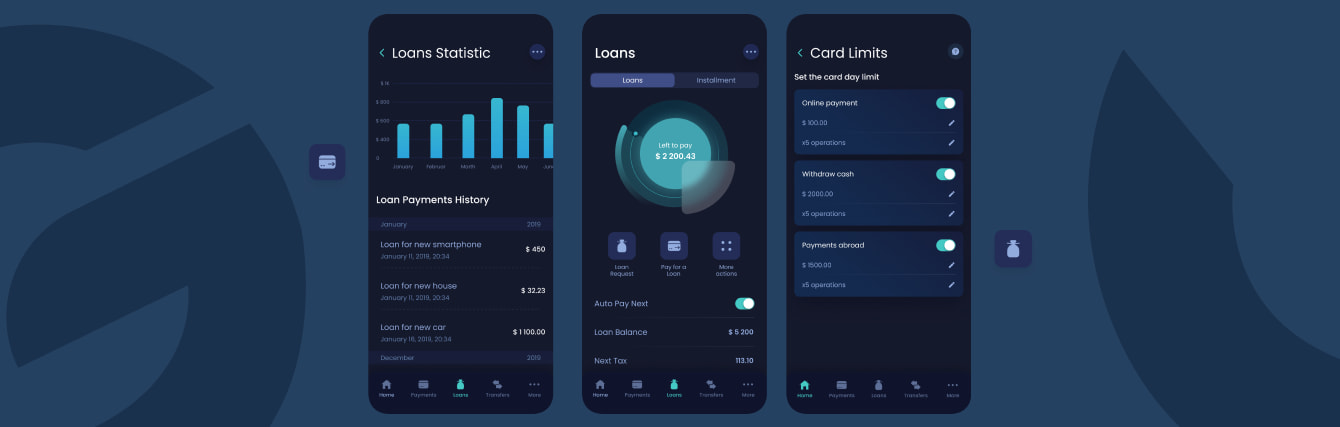

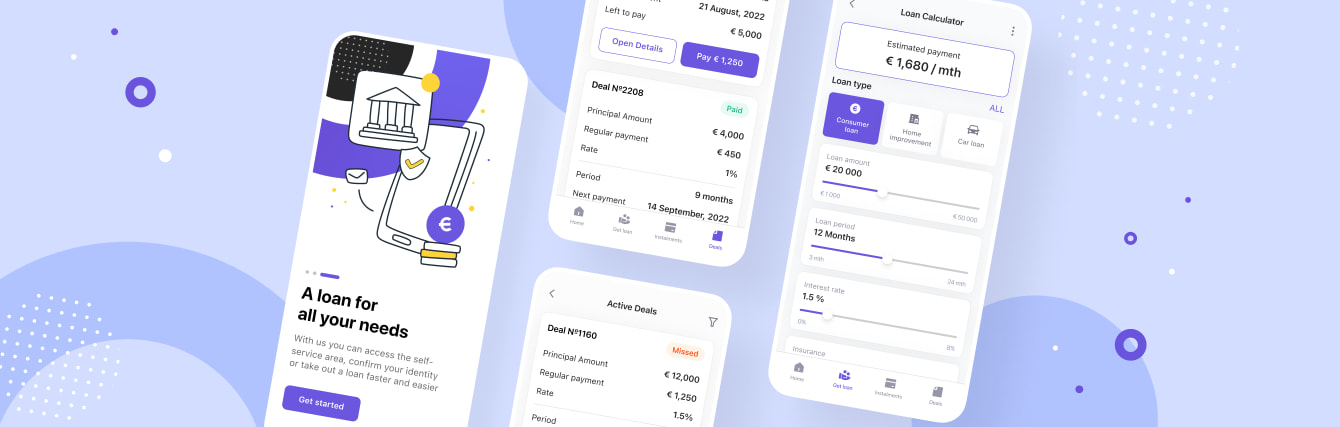

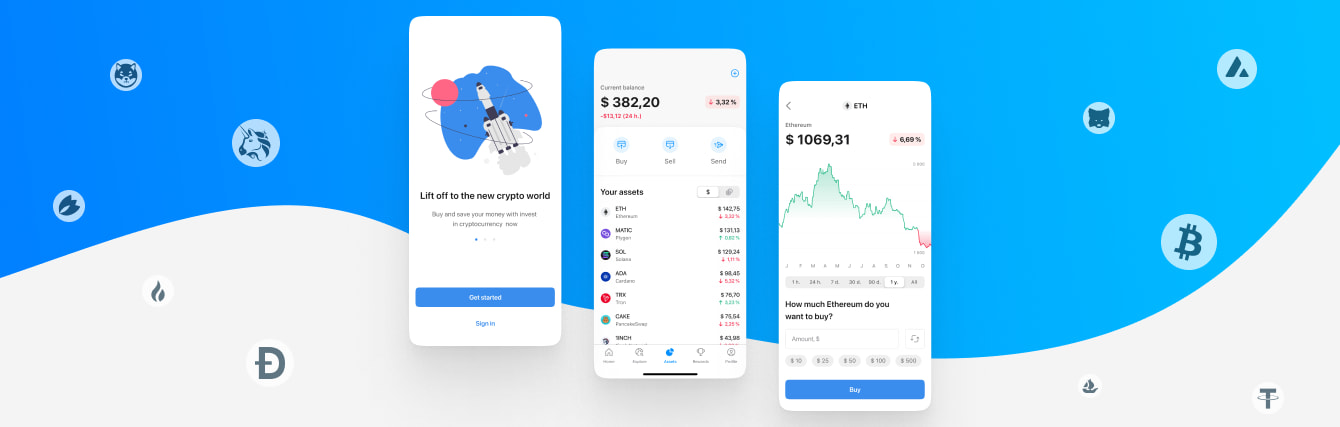

Essential Mobile Banking app features

Based on the digital banking research carried out by Andersen, our team was able to identify the key features that need to be included in mobile banking app design and development to increase apps’ popularity and user satisfaction rates.

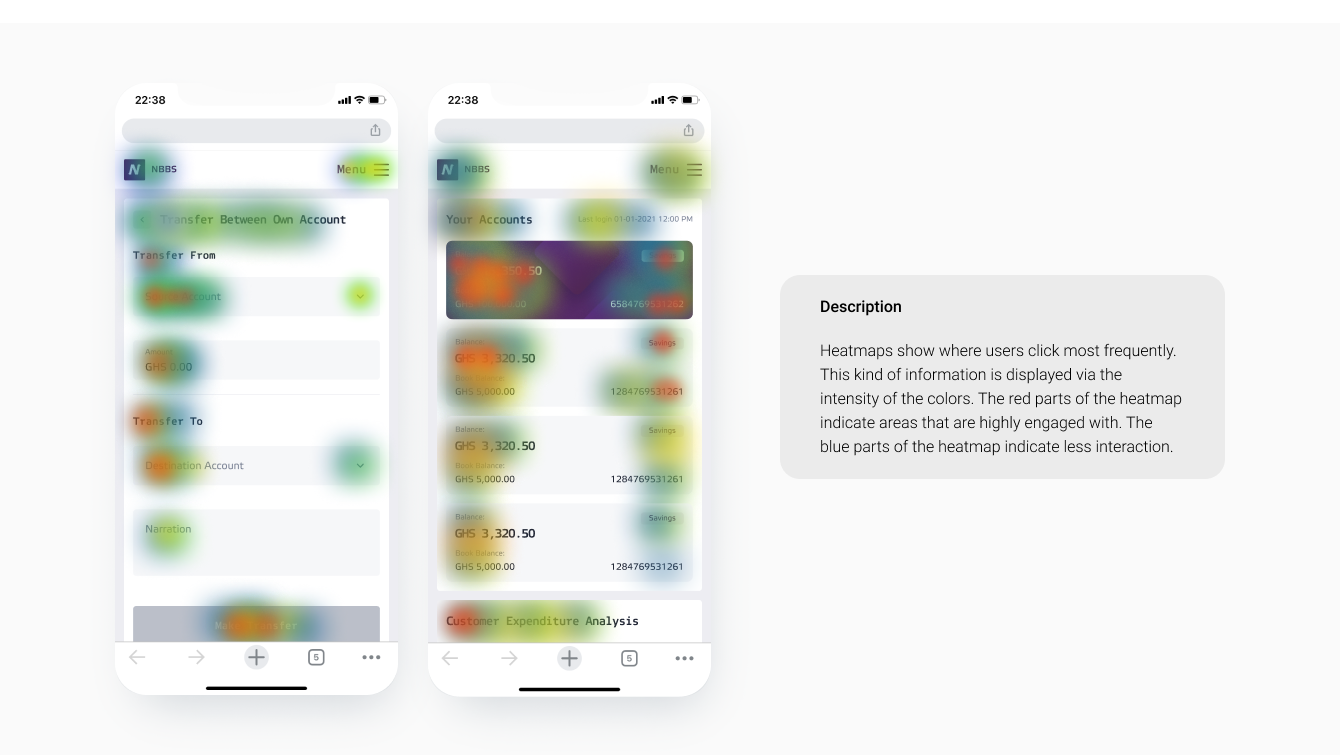

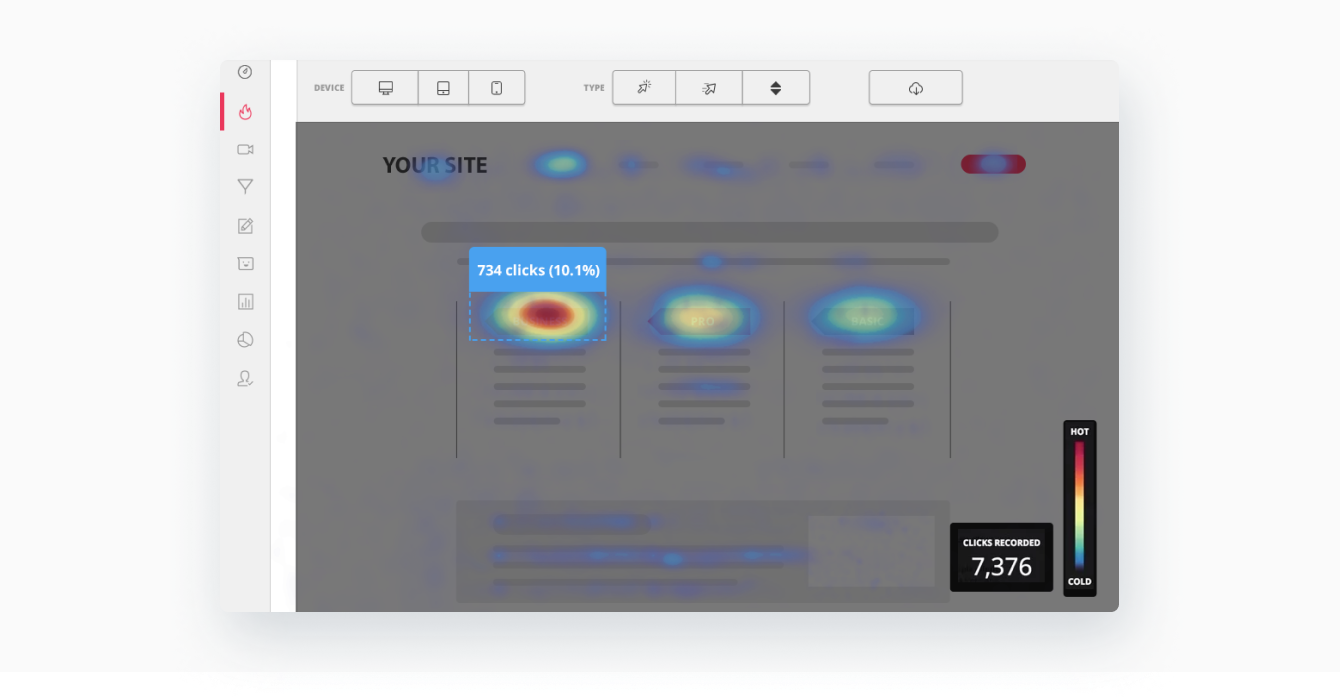

Heatmaps

While traditional mobile app analytics does provide key metrics and information on demographics, a mobile heatmap is also an essential tool that visually displays user behavior in an app. Mobile app heatmaps are a visual overlay of colors per each app screen. Heatmaps can answer a lot of questions, including why your conversion rate has dropped on a specific page or screen. You might view it as a complicated issue. However, the problem might be that, for example, users don’t understand where the “Purchase” button is located. Correspondingly, they click on something else and get an error message instead. After that, due to their negative experience with your app, they abandon it.

Webvisors

Touching on the subject of digital banking, Andersen’s team couldn’t miss the opportunity to mention banking website analytics. Webvisors help analyze user interaction with your site by recording a video covering each user session. Activated webvisors monitor the end-to-end behavior of each visitor: mouse movements, scrolling on pages, clicking on active links, keyboard typing, selecting or copying paragraphs, and filling out different forms. Via webvisors, one can also assess the overall site usability and UX design features, for example, quick views with abrupt endings or prolonged sessions with some elements. Companies use all this information for performing enhanced analytics and drawing up digital banking reports..

Responsive analytics artifacts

We analyze your product and define an optimal number of metrics to track user behavior, activity, and attention. Mobile app analytics tools provide you with a lot of info about your banking app and its usage patterns. Below is a quick look at some of the metrics usually included in analytics and online banking reports that we draw up for our customers:

Active Users

View daily, weekly, and monthly active users involved over time, including real-time data covering the number of users who have been active within the last 30 minutes, as well as the top conversion events during that period.

Conversions

Your most important events are conversions. You can view data about your top conversion events recorded over time.

Engagement

Daily user engagement displays the average daily engagement rate via a graph showing trends covering a chosen period of time.

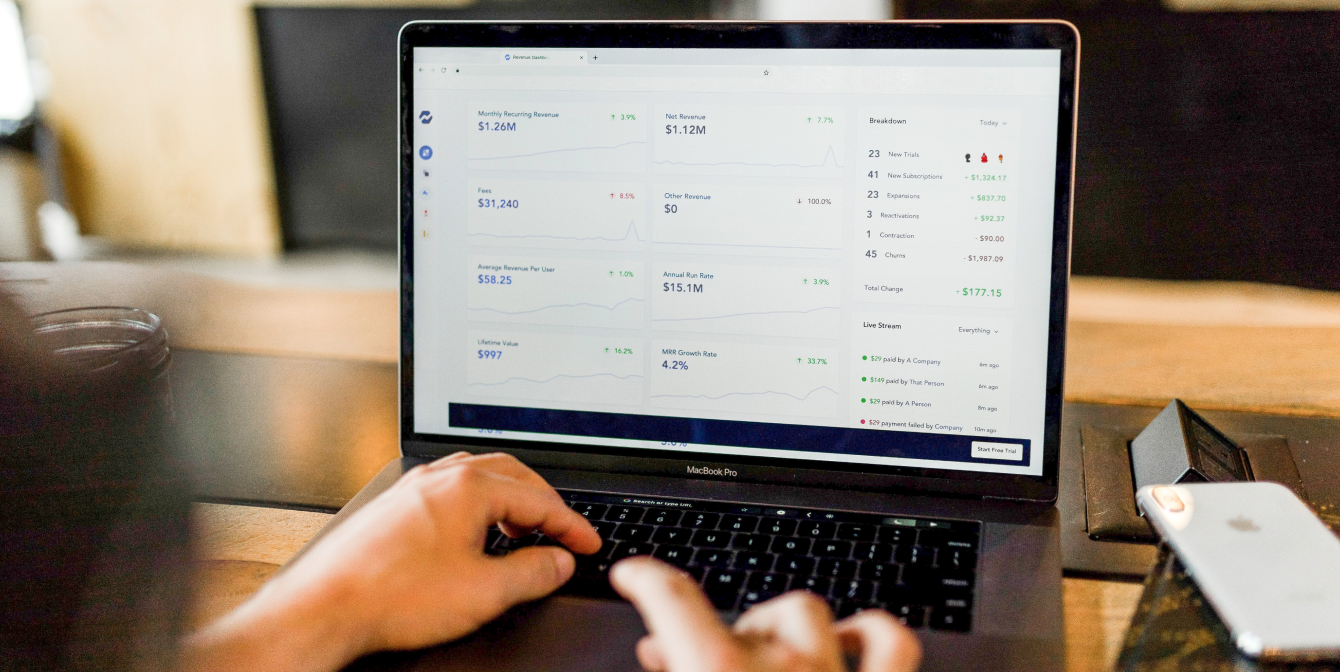

Revenue

This metric shows the total revenue amount made of the combined value generated by all revenue sources. It also shows you the revenue sources as well as the average revenue per user (ARPU) and average revenue per paid user.

Adoption and acquisition

You can view your adoption graphs by the app versions, top acquisition channels, the number of times the app was opened for the first time by each specific channel, and the user lifetime value (LTV).

Retention and audience

It represents the circle of users who started using your app at the same moment of time. You can also check out more info, which gives you an idea about your users' properties in terms of their location, devices, and demographics.

Formalization of analytical data

All data on your product that we collect will be described and transferred to you. After that, your marketers, UI/UX designers, developers, etc., will be able to use this data for their work. If you make your mobile banking solutions more convenient you will ensure such outcomes as being able to offer your customers what they really need; optimize your resources with minimum effort; reduce advertising costs; and boost audience loyalty.

Mobile app analytics is a means used to attain an important goal. It is extremely helpful in comprehending everything you need to about your own mobile app: how it is used, what works for it, what doesn’t work at all, what needs to be optimized, etc. If you apply it properly, mobile app analytics can help you reach your goals and propell your app to new dimensions.

Competitive analysis

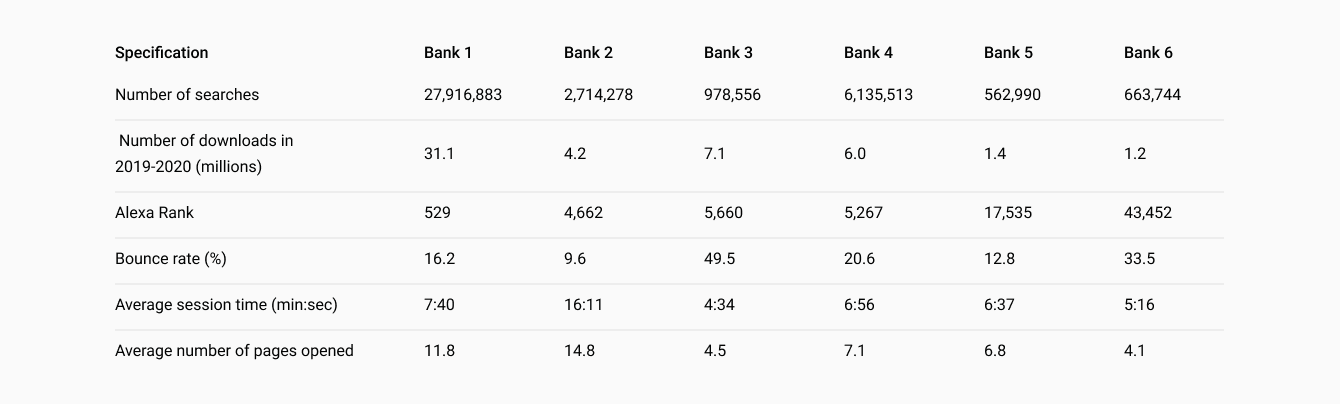

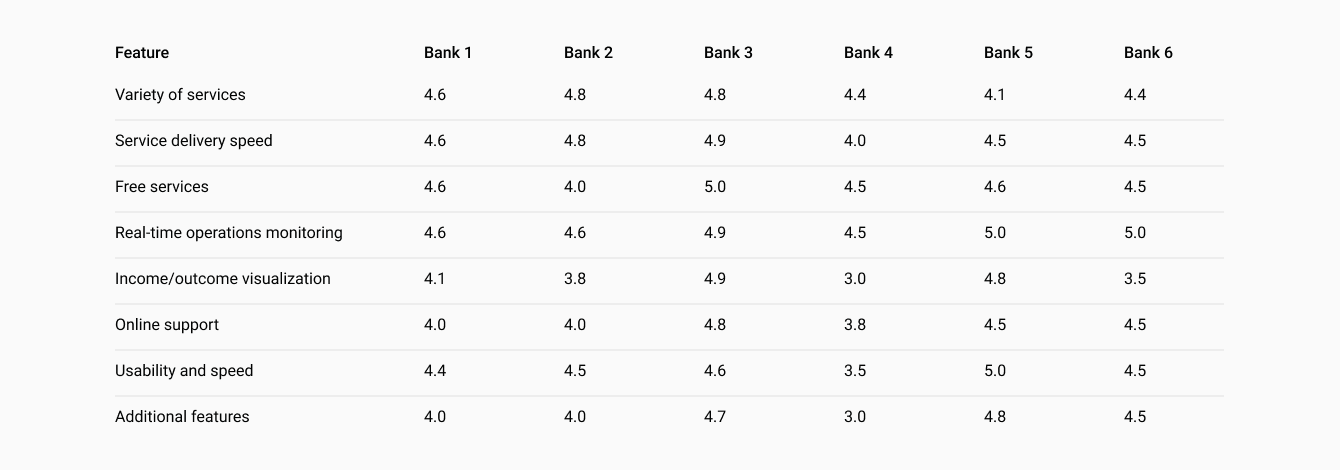

Andersen's team carried out a competitive analysis of six leading banks as part of this digital banking research. In the course of the study, our experts analyzed their key SEO metrics, available services, level of technology adoption, their apps’ functionalities, as well as financial institutions’ archetypes and location, and bank clients’ needs. Below are the insights and findings of this analysis that can help companies in their mobile banking solution development.

Data analysis

Andersen's team carried out a competitive analysis. We collected figures available with banks (impressions in search engines, Alexa rankings, bounce rates, average session time, etc.).

Analysis of services

Andersen’s team assessed the level of convenience pertaining to services provided by the banks. All the data in this digital banking report was obtained via user interviews and surveys.

Direct and indirect competitors

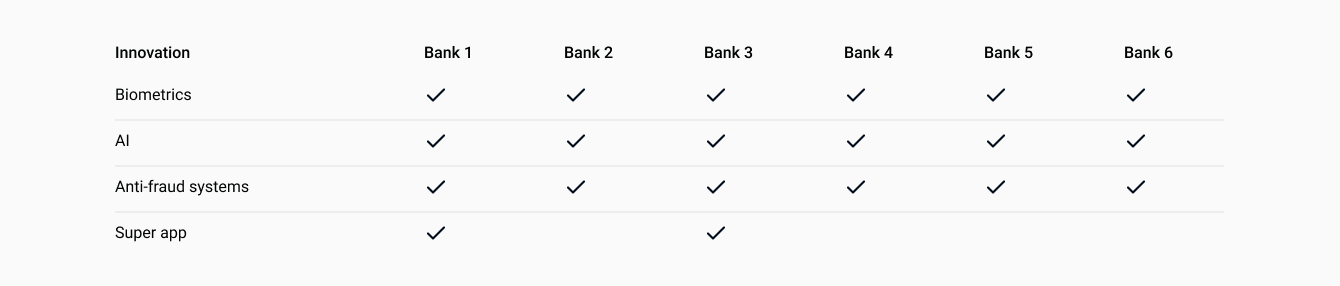

Analysis of the innovation level

To compile this digital banking market report, Andersen’s team compared the level of adoption of the key technologies in mobile solutions of the leading banks.

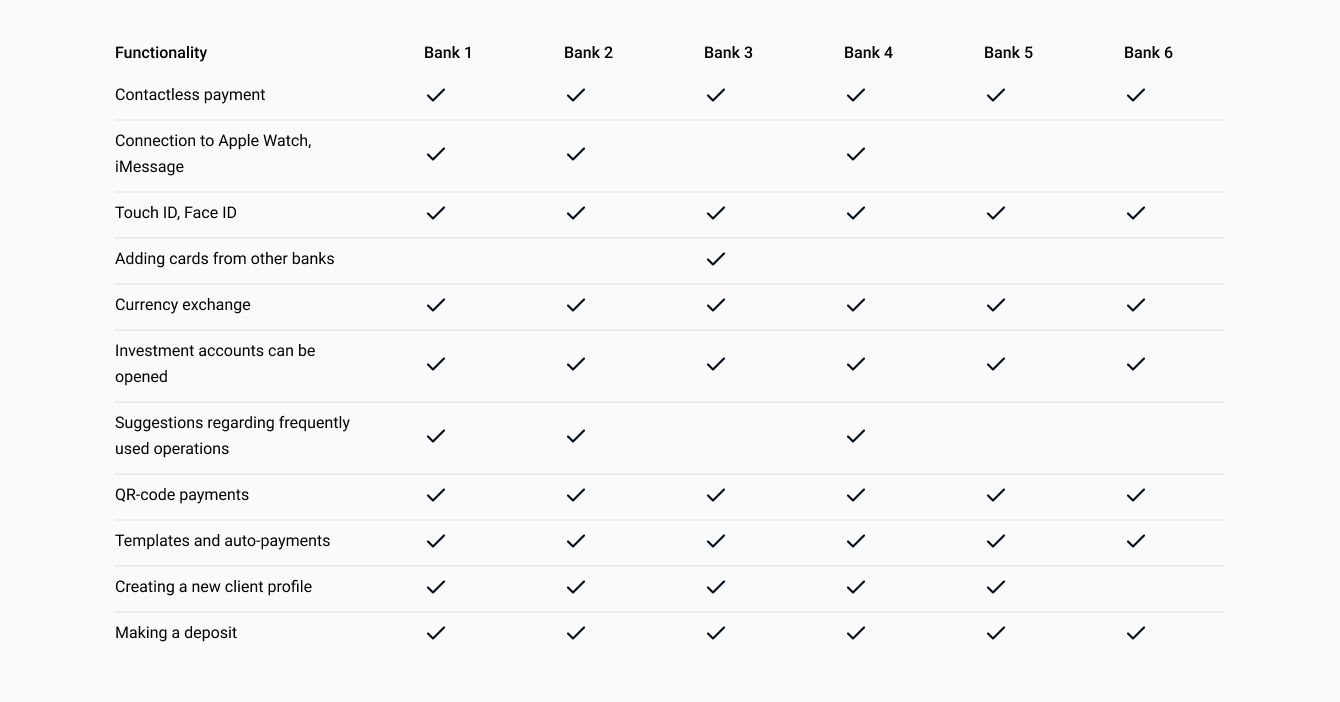

Functionality analysis

When conducting this digital banking research, Andersen’s team also checked whether the following key functionalities are included in the banks’ finance mobile app design.

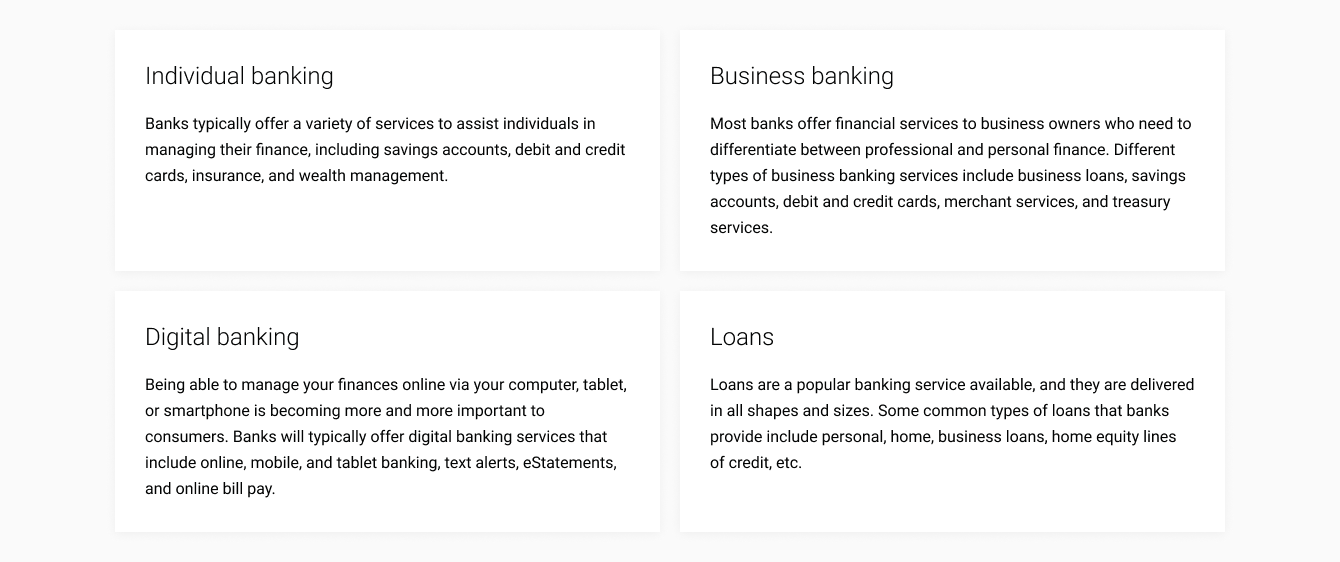

Banking services

Types of banking services and their properties

When drawing up this mobile banking report, Andersen’s team considered it necessary to divide the most popular banking services into the following categories. Such classification should take place when carrying out a competitive analysis so that you are analyzing banks in the same group.

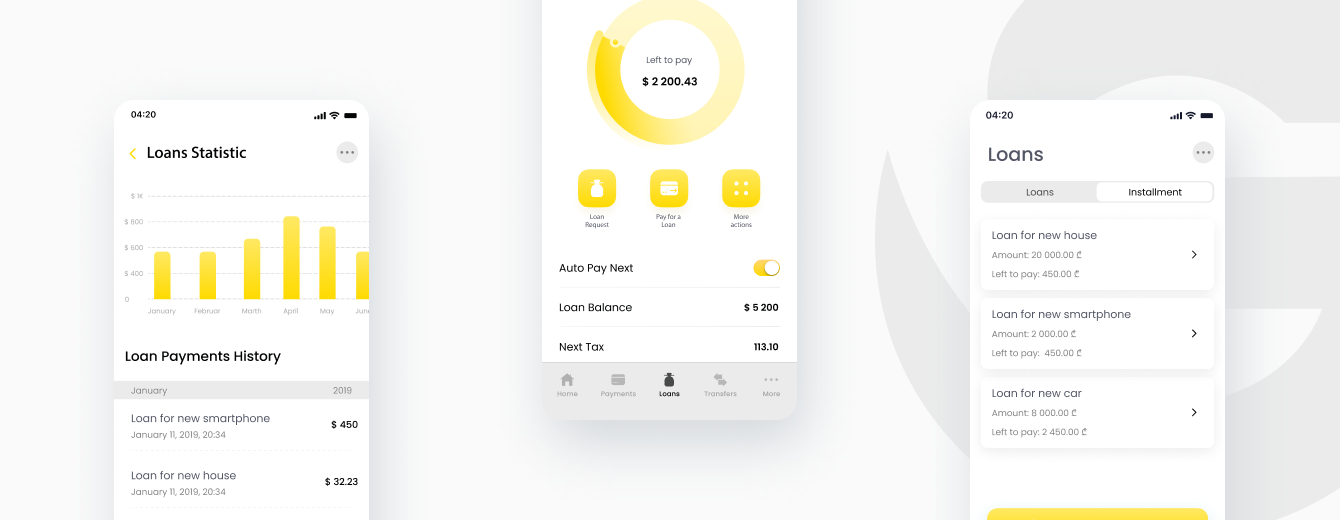

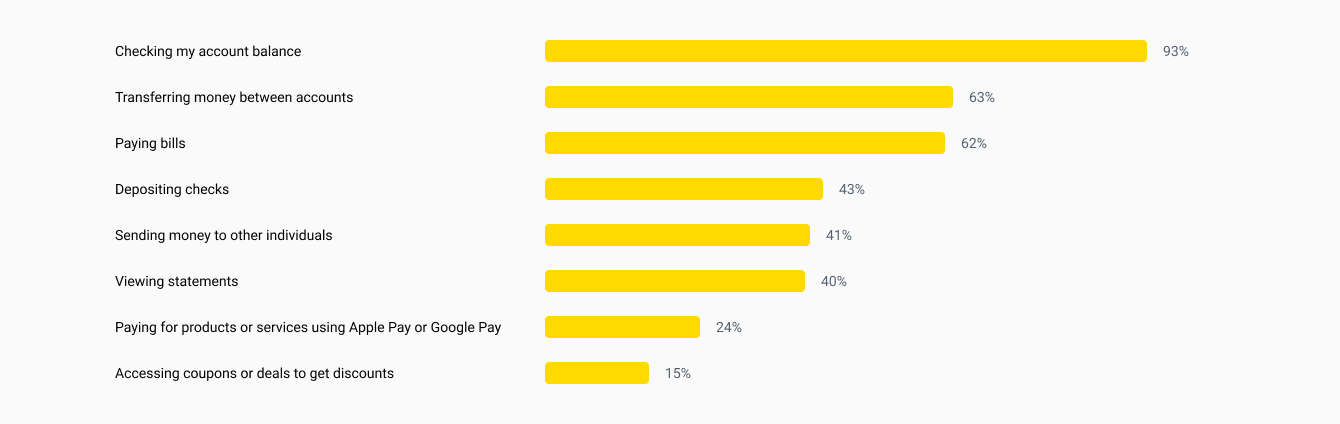

Mobile banking features

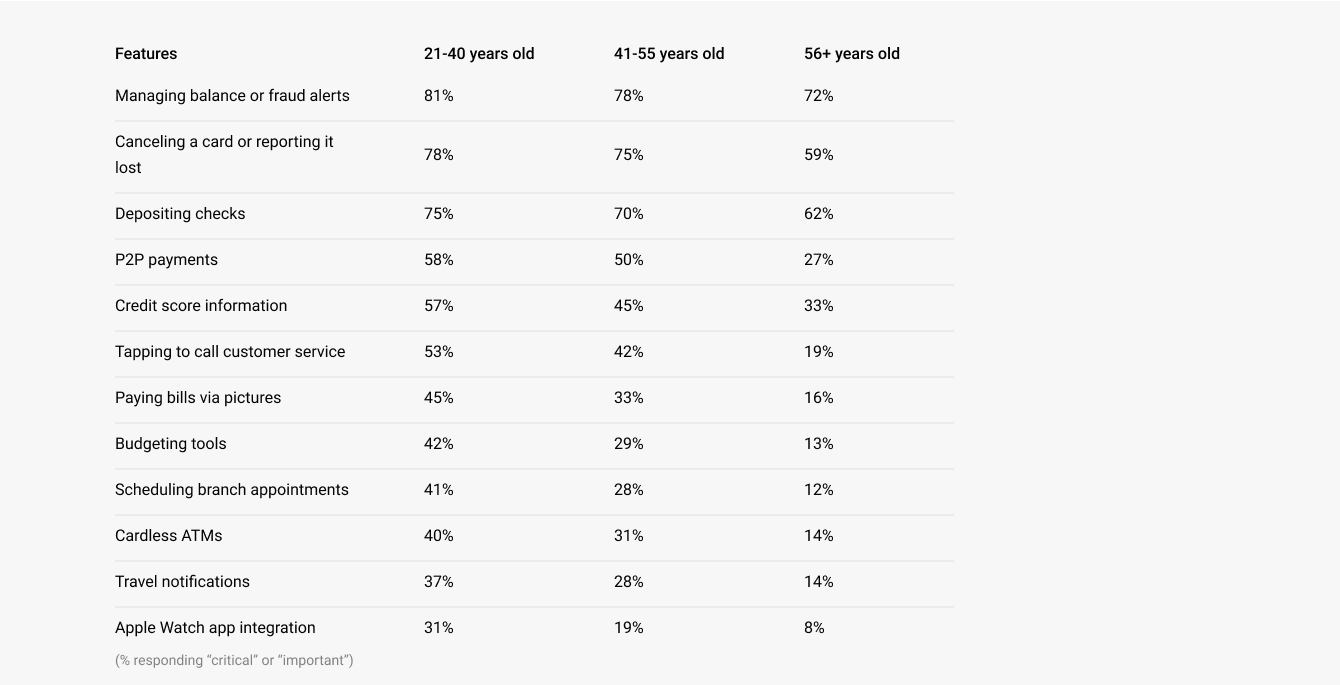

Andersen's team analyzed the main functions featured by mobile banking, as well as their importance for the users

Back in 2020, which of the following banking services have you used?

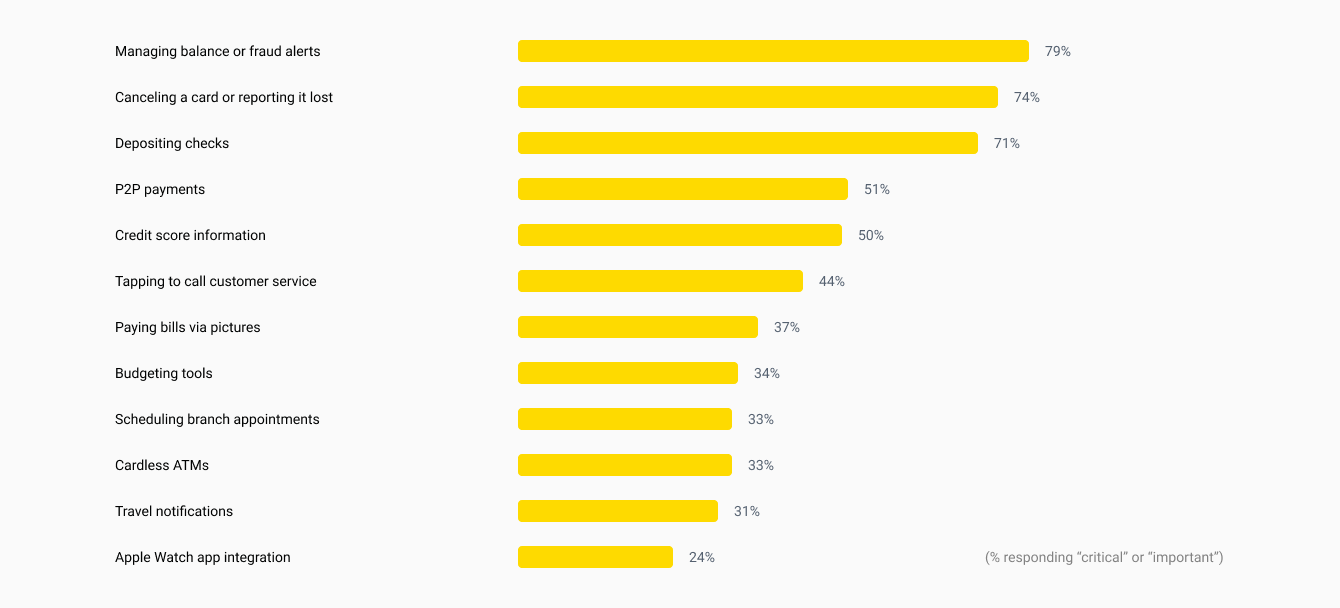

How important are the following mobile banking capabilities?

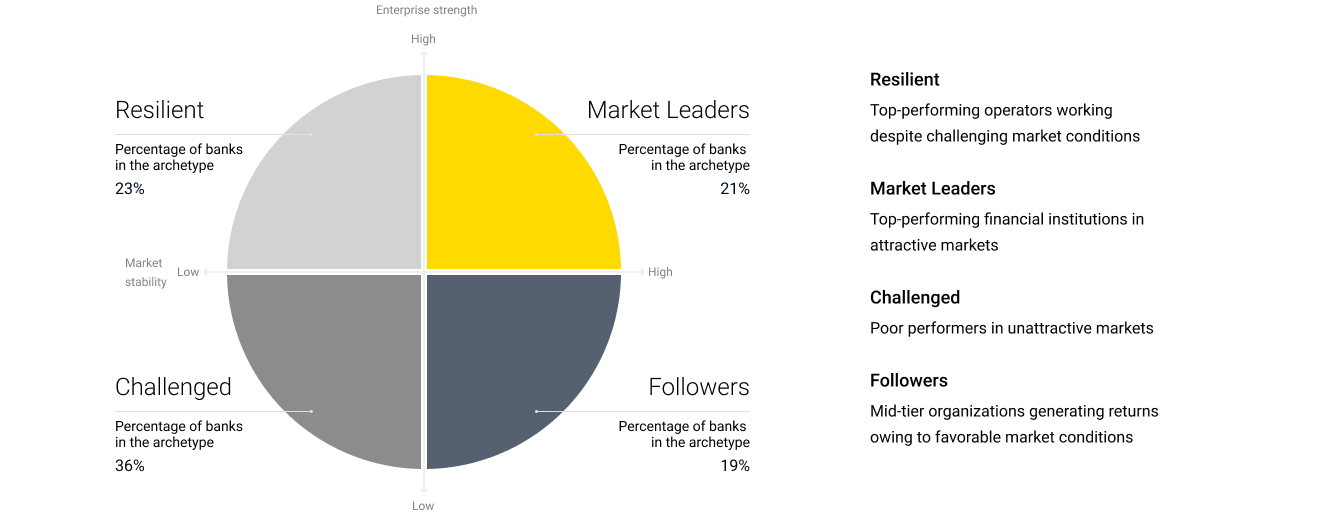

Audience archetypes

Taking into account the fact that each bank is unique and the levels of flexibility depend directly on their business models, we identified a range of tools ensuring greater profitability and divided them into 4 archetypes.

Geographic location

When working on this online banking report, Andersen’s team identified which archetypes prevail in specified regions. Banking archetypes with low market stability are primarily located in Western Europe and Asia’s developed nations, while archetypes with high market stability are concentrated across the emerging markets of Asia and North America.

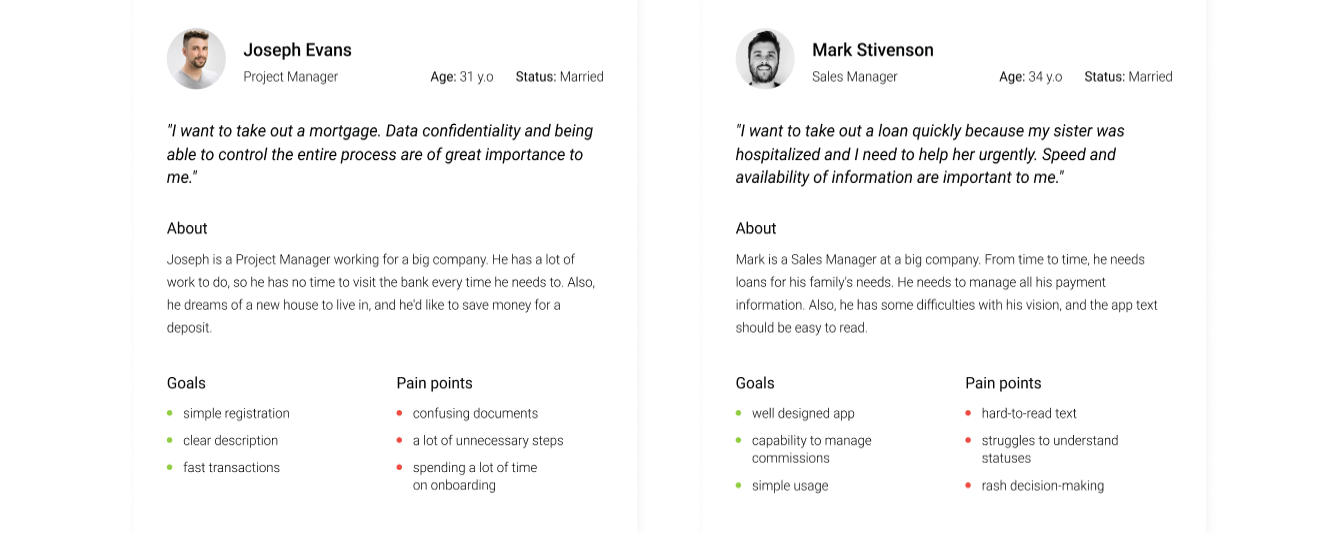

Marketing personas

We Identified the main marketing personas and tracked the specific character of their mobile banking usage patterns, depending on particular regions where users reside.

How important are the following mobile banking features?

Mobile banking for SMEs

The customer ordered a cross-platform mobile solution to be used by SMEs as an alternative to traditional finance apps. The app was built as a first-in-class tool "designed by entrepreneurs for entrepreneurs" in the Gulf region.

Mobile Bank for Small Businesses

Native Android & iOS mobile applications for finance management with all essential features including customer finance management

Bitcoin Wallet application

Development of new functionality and support of the functioning P2P platform (for buying and selling BTC) with the elimination of technical debt.

Banking document management system

The goal was to build an e-document management system (DMS) for a financial entity. The solution was built as a desktop application integrated with the customer’s desktop CRM system and a range of its web-based apps.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us