The customer chose to protect their confidential information

A FinTech Tool to Automate Compliance and Risk Management

About the client

Andersen's customer, in this business case, was a company working in the world of finance. They needed a FinTech solution to help them with their core business, i.e. compliance control and risk management.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/usa-desktop-2x.png)

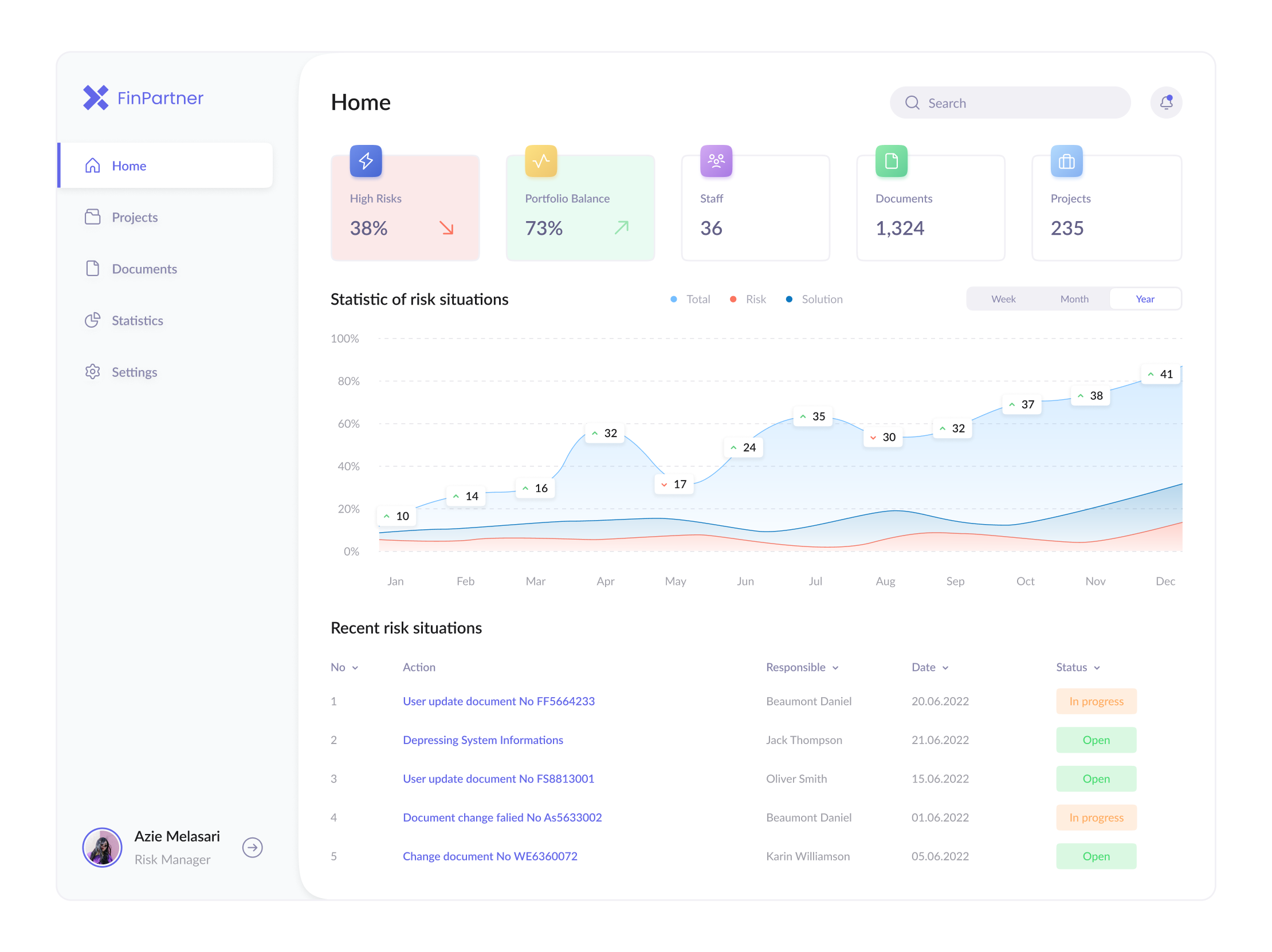

Visual concept

A system for automation of compliance control and risk management. The main function is the risk assessment of cooperation with a client (business and individuals). Risks are assessed on the basis of legal requirements (individually for each country) and on the basis of the internal business rules of the analyzing party.

Application functionality

- Risk analysis for new clients (onboarding)

- Monitoring the level of risk for existing customers

- Import of data for analysis from external systems - sanction registers, credit registers, banking systems (for transaction analysis), etc.

- Analytics and reporting - statistics broken down by customer segments, risk groups, etc.

- Rule constructor - creating and editing custom rules, as well as notifications for them

- Customer management - distribution of access, customization of system settings for a specific client

Solution

Technical solution consists of several web services and DWH. Main technology stack - .Net, Angular, Scala, Python and Apache tools.

Results

Development of a system that reduces the complexity of risk analysis for the client and the number of errors caused by the human factor.

- The groundbreaking finance tool has had a significant positive impact on the customer's operations;

- The use of the latest technologies and innovative approaches simplified the risk analysis process and reduced the number of errors;

- More efficient and effective compliance processes resulted in increased automation, allowing the business to focus on high-value tasks;

- The amount of non-compliance issues has decreased since the implementation;

- The project serves as a model for future technology-driven business process transformations.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us