- Automotive software niche: figures

- Automotive software niche: dimensions

- What Andersen perceives as promising directions for our business development and growth

- Capabilities of Andersen as a custom Automotive software provider

- Automotive talent pool

- Automotive qualifications, certifications, and achievements

- Examples of Andersen’s partnerships

- Project # 1

- Project # 2

- Project # 3

- Challenges Andersen overcomes within the Automotive software industry

- Andersen’s Automotive plans

The niche of Automotive software development is a growing and lucrative one. It is expanding both quantitatively and qualitatively. Therefore, we dedicate a lot of effort to strengthening our presence in this domain, serving our existing customers, establishing new partnerships, and accumulating even more resources for our pioneering and ambitious engagements. This piece seeks to promote our understanding of where the Automotive software segment is going, as well as what role Andersen intends to play in this progress.

Automotive software niche: figures

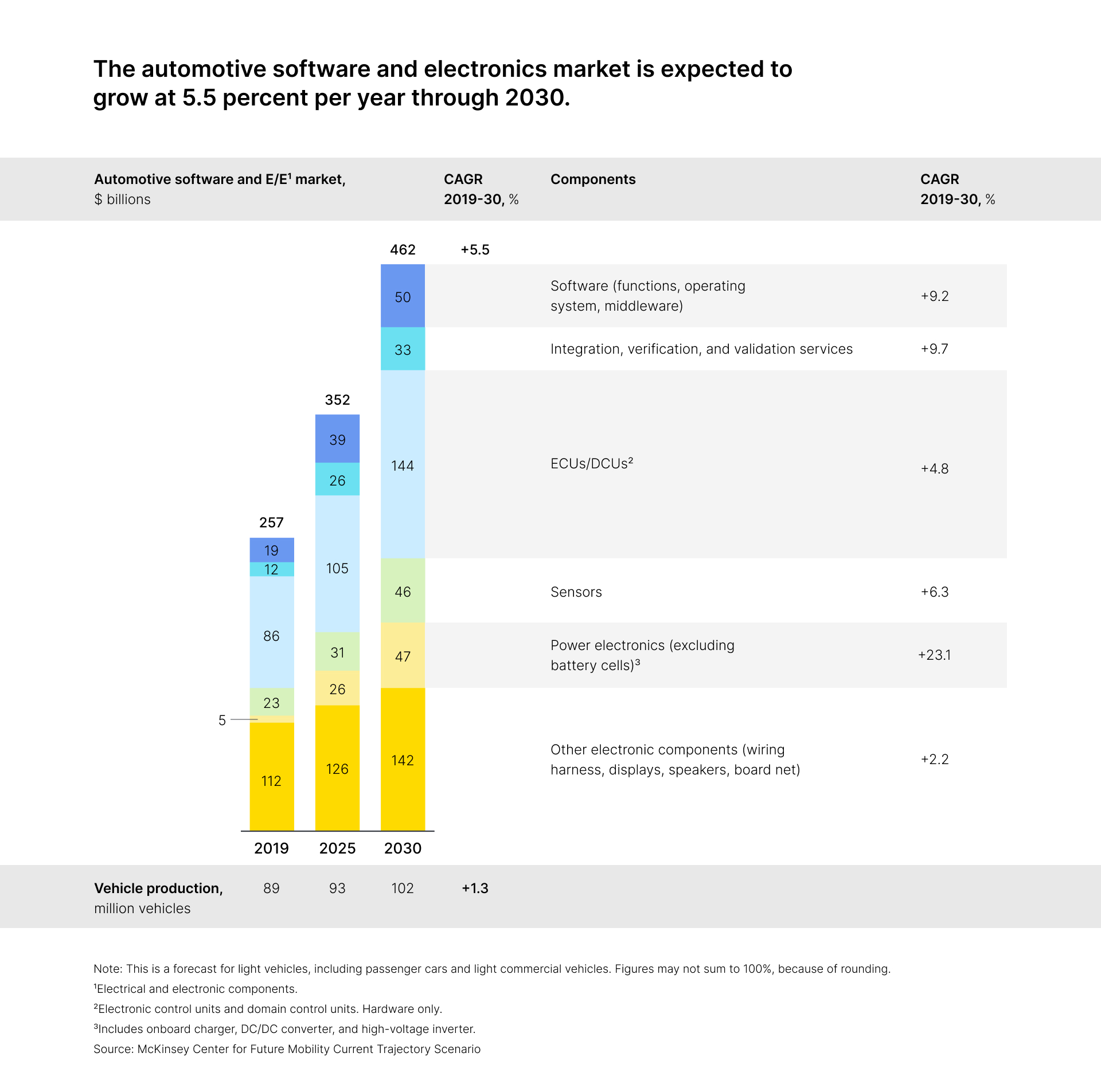

To begin the discussion, let’s cite some figures that have recently been made available by McKinsey’s knowledgeable experts. According to them, from the starting pre-COVID-19 point in 2019, when its size was “merely” $257 billion, the Automotive software and electronics market will hit an astonishing $462 billion around 2030. Of that total volume:

- Software, our key domain, will account for $50 billion;

- Integration, substantiation, and authentication – also a point of corporate interest to Andersen – will make up $33 billion;

- Electronic and door control units will get the biggest share of $144 billion;

- They will be followed by power electronics with $47 billion;

- Sensor technologies will generate $46 billion;

- Finally, other e-components will reach $142 billion.

Not all of the above facets are of immediate relevance to Andersen, yet the promising prospects revealed by the market motivate us to establish our company as a truly ambitious and advanced player.

Automotive software niche: dimensions

The Automotive software and electronics segment is experiencing such impressive growth for a reason. ACES (autonomous, connected, electric, and shared) is how vehicles are assumed to look and function in the coming years. The ascendance of the ACES factor is altering the nature of Automotive industries and making extensive investments in next-generation tech a must.

The combo of autonomous driving and connected vehicles, coupled with e-power and shared mobility, builds upon an entire constellation of simultaneous factors mandating profound transformation. Among them are:

- The COVID-19 pandemic and the legacy of social distancing with the growth of remote approaches;

- Tougher environmental protection measures;

- Growing restrictions on access to downtowns and urban areas;

- A gradual shift to non-ownership practices, such as car-sharing, subscriptions, and micro-mobility;

- Recent AI breakthroughs, and more.

What Andersen perceives as promising directions for our business development and growth

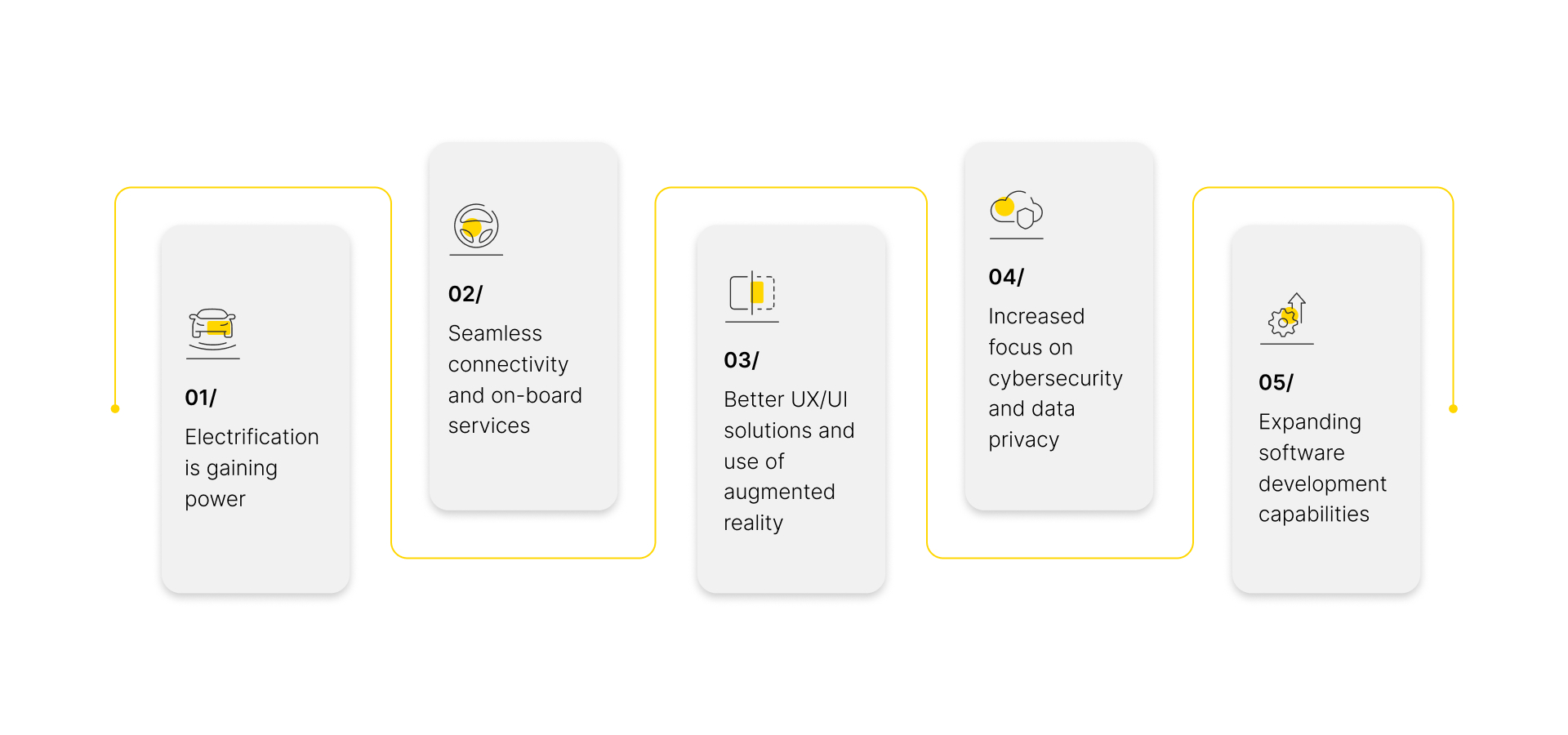

To name a few directions, we’d like to point out the following ones:

- First, solutions for connected cars based on our IoT expertise, including over-the-air (OTA) software updates, real-time diagnostics and tracking, data exchanges with other devices and pieces of equipment, etc.;

- Second, programs for e-vehicles to manage battery systems, optimize energy consumption patterns, V2G, V2I, and V2E communication, etc.

- Third, Advanced Driver Assistance Systems (ADAS) build on, among other things, AI and ML capabilities, encompassing adaptive cruise control, lane-keeping assistance, automatic emergency braking, image recognition, voice commands, and more;

- Fourth, cyber security software solutions engineered to protect vehicles from hacking and data breaches;

- Finally, UI/UX projects are also an obvious priority for Andersen – for example, infotainment systems, voice assistants, and intuitive controls.

Capabilities of Andersen as a custom Automotive software provider

Our team, possessing theoretical expertise and practical skills trained on over 1,000 challenging and data-intensive projects (including those within the Automotive domain), is our most valuable asset. Having a team of over 120 industry-focused professionals and taking pride in our 16-year-long track record, we are fully prepared to help in achieving goals set by Automotive businesses. This is what we offer:

Automotive talent pool

In the realm of Automotive innovation, Andersen has assembled a multidisciplinary team comprising true IT professionals, each possessing the required qualifications and a wealth of experience. The team includes:

-

Embedded Software Engineers: The core of our team consists of proficient embedded system professionals who specialize in crafting software and firmware tailored expressly to Automotive applications. With a profound expertise in the integration of software and hardware for diverse functions, they exhibit a mastery of Automotive communication protocols: CAN, SPI, I2C, Bluetooth, Wi-Fi, and IoT. On top of that, their deep knowledge covers microcontrollers, real-time operating systems, and the intricacies of low-level programming languages, including C, C++, C#, Python, and more. Also, our Automotive team employs specialists in ECU development, ranging from engine control units to cutting-edge driver-assistance systems (ADAS), with an accentuated commitment to adhering to ASPICE standards.

-

Automotive Software Architects: Our architects are fully capable of designing and implementing state-of-the-art and dependable software architectures for the Automotive domain. Focusing on Automotive software development activities, they are particularly interested in safety-critical systems. Andersen’s architects are proficient in globally accessible and standardized AUTOSAR principles (aka AUTomotive Open System ARchitecture used by industry players) and well-versed in layered architectural concepts, communication stacks, and component templates.

-

Automotive QA and Validation Engineers. Their mission is to ensure that our embedded systems not just meet but even exceed industry benchmarks and perform seamlessly in real-world scenarios. Typically holding degrees in electrical or computer engineering, they all boast an impressive 5 to 10 years of hands-on experience in formulating and executing rigorous QA plans, meticulously aligning them with industry standards. The vast majority of our specialists hold certifications from the esteemed International Software Testing Qualifications Board (ISTQB).

Automotive qualifications, certifications, and achievements

The qualifications and “badges” of experience found in our team span an entire spectrum, ranging from bachelor's degrees to advanced credentials like master's degrees or PhDs – all relevant to their specific domains of expertise. We would like to draw your attention to:

- TISAX – Trusted Information Security Assessment Exchange certification;

- Our compliance with the ASPICE standards (i.e. Automotive Software Process Improvement and Capability Determination);

- Andersen’s conformity with ISO 26262 stipulations (pertaining to engineering electronic systems for vehicles).

From a practical perspective, Andersen is a dependable source of tech and managerial excellence for Automotive customers. Among other things, we can ensure:

- Comprehensive process documentation;

- Test running time reduced by 70%;

- Fast onboarding of new team members;

- Debugging time spans reduced by 30% on average;

- Comprehensive coverage of all requirements by all necessary tests;

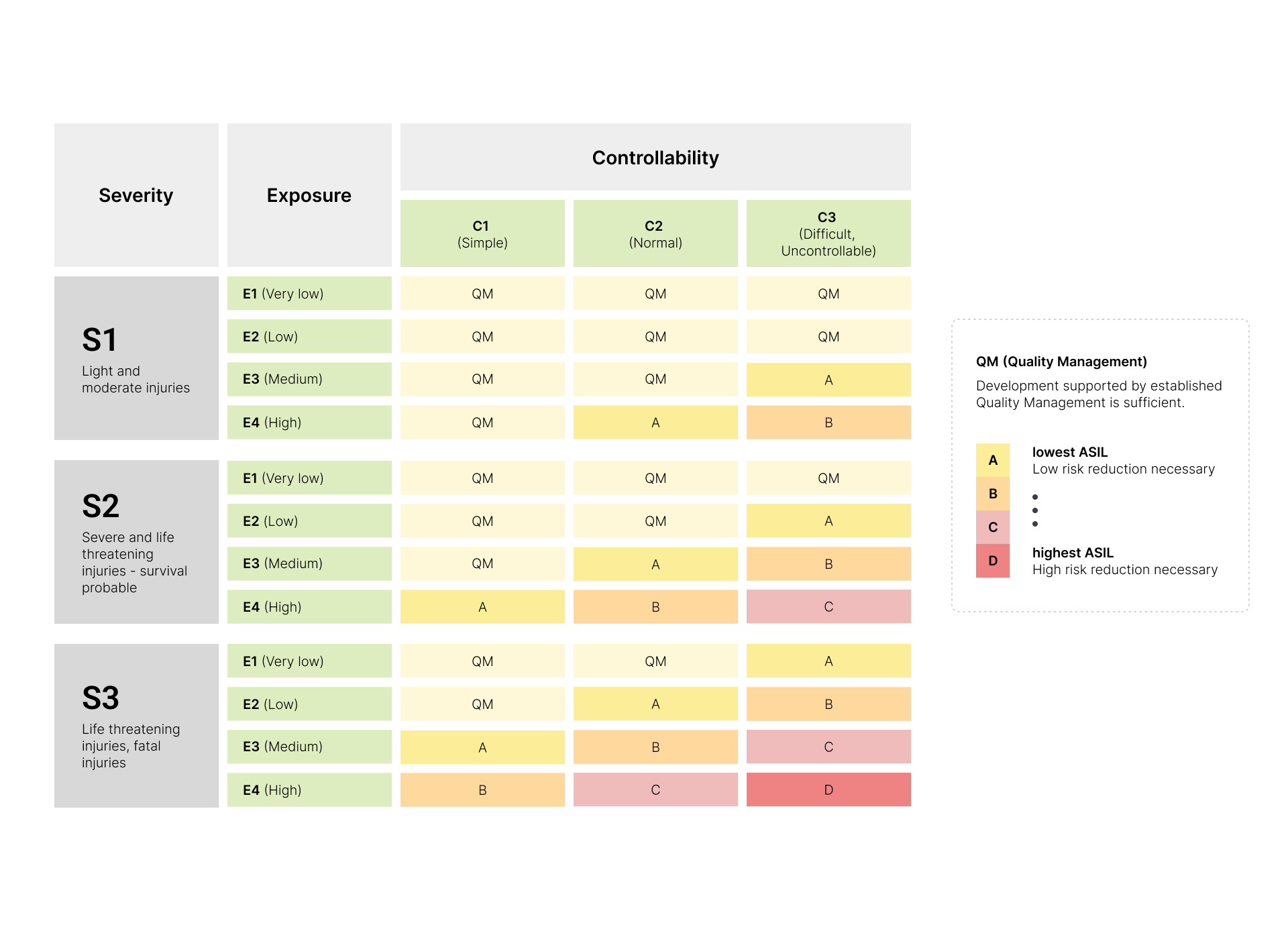

- Significant reduction of defect rates in full conformity with the applicable ASIL requirements (ASIL (Automotive Safety Integrity Level), as a risk classification framework, is outlined by the aforementioned ISO 26262 – see more below);

- Development and deployment of safety-critical solutions in a fully compliant fashion;

- Automation of test processes.

ASIL explained

Applied to the engineering of safety-sensitive and safety-critical systems in e-vehicles, ASIL dictates applicable norms, encompassing:

- Lowest A level of Safety Integrity, when minor injuries are possible as a result of a failure;

- B level, when moderate injuries are at stake;

- C level, implying that failures may lead to severe body injuries and even life-threatening situations;

- D level, when fatalities are possible.

ASIL A applies to, for instance, interior lighting, while ASIL D regulates braking or autonomous driving systems.

Examples of Andersen’s partnerships

We are actively engaged in collaborations with several enterprises belonging to the Automotive industry, capitalizing on existing synergistic opportunities to propel innovation and add it to their offerings. Working with both suppliers of Automotive systems and esteemed research entities, we have established ourselves as a trusted, cost-effective, and pioneering vendor. Below, you will find some examples of our partnerships.

Project # 1

Modern technologies, ranging from satellite navigation to cutting-edge driver assistance systems, are already in the right position to enable the recording of vital vehicle data, its delivery to the driver, and integration with online services in real-time.

Andersen’s customer, in this business case, is pushing the boundaries by enhancing the connectivity of individual components. Modern infotainment management goes beyond merely displaying vehicle data; it establishes a comprehensive human-machine dialogue, enabling seamless information exchange among humans, vehicles, and the external environment. The streamlining of in-car information management in our increasingly intricate world unlocks opportunities for novel vehicle capabilities, such as autonomous driving and the seamless incorporation of mobile devices.

Our Automotive software team was entrusted with helping the customer across all these areas. Andersen’s achievements in this autonomous driving project include:

- Safety performance. AVs have exhibited a remarkable 45% reduction in collision incidents compared to human-driven vehicles, underlining their potential to enhance road safety;

- Collision avoidance. AVs have achieved a 98% success rate in real-time collision detection and response, minimizing accident risks;

- Pedestrian and cyclist interaction. AVs have demonstrated a 92% accuracy rate in detecting and yielding to pedestrians and cyclists in urban environments;

- Traffic flow optimization. AVs have improved traffic flow efficiency by 30% through adaptive route planning and traffic management algorithms;

- Real-time decision-making. AVs have displayed efficient responses with an average 0.2-second reaction time in complex traffic situations;

- Sensor fusion and perception. AVs have achieved a 95% detection accuracy rate for objects, vehicles, pedestrians, and cyclists;

- Human-machine interface (HMI): The HMI for the AVs has been rated 4.5 out of 5 by users thanks to effectively communicating vehicle actions and thus enhancing user trust.

Project # 2

This collaboration was centered on testing electric vehicles (EVs) in hot climates to evaluate their performance, including battery efficiency, range, drivability, charging, durability, climate control, and regenerative braking. Our multidisciplinary assessment group gave crucial insights into EVs’ suitability and reliability in challenging weather conditions.

When working on this project, our QA specialists revealed the following:

- Battery efficiency. Hot climates led to a 15% average decrease in the EV battery efficiency compared to moderate regions, highlighting the impact of high temperatures;

- Range. In hot climates, the EVs showed a 20% average decrease in range, underlining the influence of extreme temperatures on driving distance;

- Performance. High temperatures minimally affected dynamic performance (acceleration, handling, drivability), indicating consistent performance in extreme weather;

- Charging efficiency. The assessment revealed effective charging in extreme weather, optimizing energy use and charging times;

- Durability and climate control. Vehicles remained durable and maintained cabin comfort in hot climates without compromising battery efficiency;

- Regenerative braking. Regenerative braking systems enhanced energy efficiency and extended range in extreme weather conditions.

Project # 3

This partnership was focused on testing and evaluating autonomous vehicles (AVs) in urban settings to enhance their safety and performance. We aimed to understand how AVs would operate in complex city areas, interact with other road users, and handle diverse traffic situations. Through this comprehensive assessment, we sought to improve the safety, reliability, and acceptance of AVs in urban areas. All the goals were met.

Challenges Andersen overcomes within the Automotive software industry

When Automotive projects are at stake, our developers and QA engineers encounter distinct challenges caused by the intricate and safety-critical nature of corresponding systems. These challenges – and our responses – can be grouped into several categories:

- Regulatory compliance. Meeting strict safety standards like ISO 26262, which requires comprehensive documentation and testing. Our solution. Establishing clear processes, staying updated with standards, and utilizing compliance tools.

- Functional safety. Making sure that the software solutions we deliver function reliably, even in fault scenarios, through safety mechanisms and rigorous testing. Our solution. Implementing redundancy, fail-safe modes, and safety-oriented processes like HARA and ASIL.

- Cyber security. Protecting vehicles from cyber threats by adopting holistic approaches, secure coding, and assessment practices, as well as collaborating with experts. Our solution. Enhancing cyber security practices and partnering with cyber security centers of excellence.

- System complexity. Integrating complex software ecosystems seamlessly in modern vehicles, with modular architectures and standardized interfaces. Our solution. Employing modular and scalable architectures, along with standardized communication.

- Software updates. Ensuring reliable and secure OTA updates with robust mechanisms and rigorous testing. Our solution. Implementing secure bootloaders, cryptographic verification, and comprehensive testing.

- Scalability. Designing software to accommodate future features and updates through flexible, modular architectures. Our solution. Prioritizing flexibility and scalability in terms of software design.

- Cross-disciplinary teams. Effectively communicating and cooperating among diverse teams of engineers and experts. Our solution. Fostering open communication, sharing knowledge, and using cross-functional tools.

- Budget constraints some customers might be facing: reducing costs through automation tools and prioritizing safety over non-essential features. Our solution. Investing in automation and prioritizing safety-sensitive and safety-critical aspects.

- Time limits: Meeting industry competition by accelerating development and testing cycles via Agile methodologies, DevOps, and CI/CD pipelines. Our solution. Implementing Agile practices, DevOps, and CI/CD for faster development cycles with deeper knowledge and total alignment of all stakeholders.

Andersen’s Automotive plans

Our vision and future growth paths in the Automotive industry are comprised of:

Market expansion:

- Exploring new markets with growth potential, especially in emerging economies;

- Adapting products to get them totally aligned with local preferences and regulations.

New partnerships:

- Collaborating with Automotive manufacturers, tech firms, and mobility providers to add more projects to our constantly growing portfolio and body of practical knowledge.

Customer-centric approach:

- Constantly gathering, analyzing, and applying customer feedback, both internal and publicly available, to enhance product features and after-sales service;

- Offering modern and flexible project ownership options.

Finally, safety and regulatory compliance:

- Prioritizing safety, together with our customers, through global safety standards and advanced driver assistance systems (ADAS);

- Staying informed about evolving regulations in emissions, safety, and cyber security.

Are you contemplating a new initiative in the Automotive domain? Let’s cooperate and get things done together!