The customer chose to protect their confidential information

Retail Banking 360-Degree View Solution

About the customer

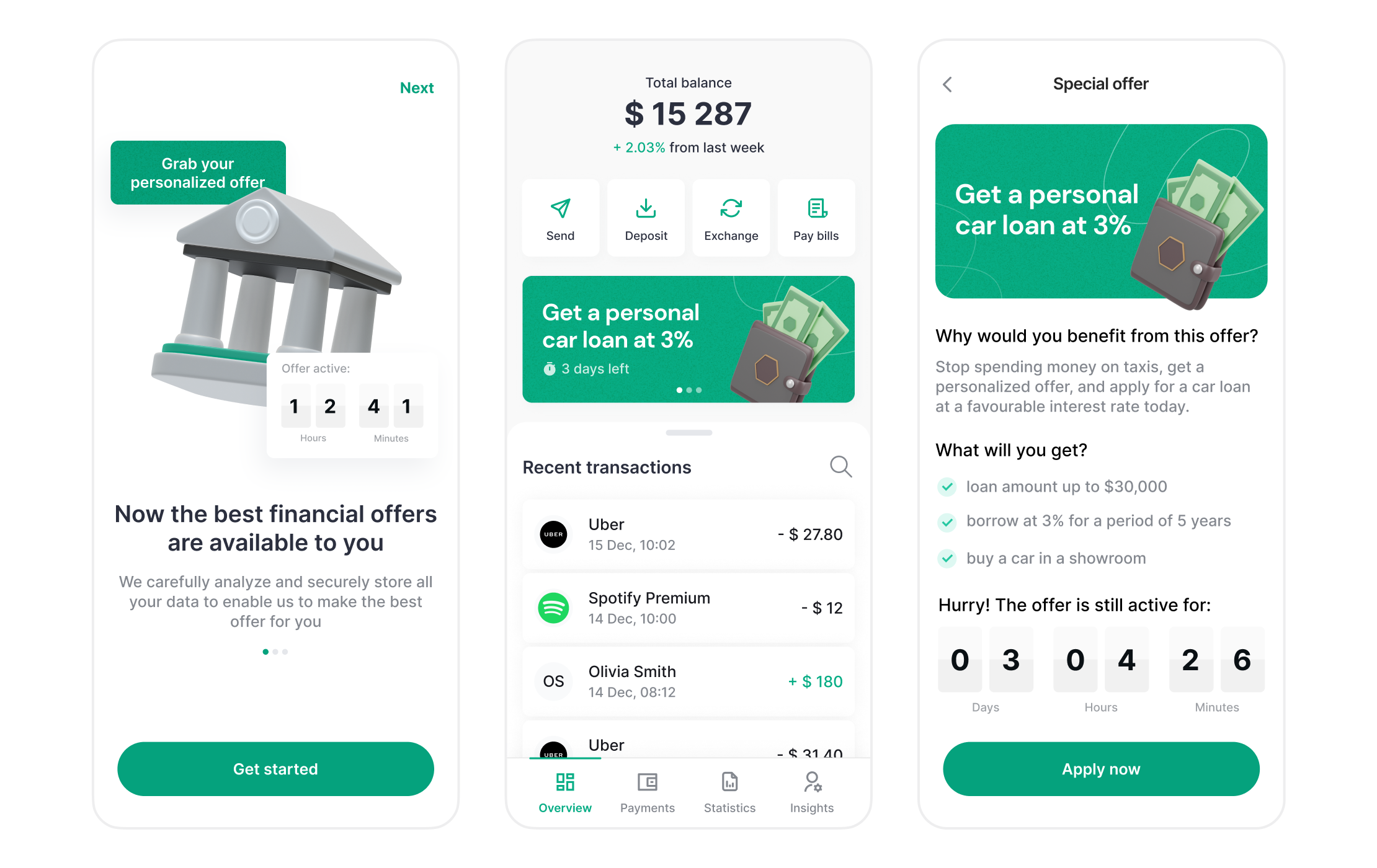

Andersen's team was approached by a retail bank serving over 10 million clients. All of them regularly interact with the bank and use its services. To improve business efficiency and make the most of this client base, the customer wanted to obtain a tool capable of identifying clients with a high propensity to accept cross-sale offers. Also, they requested the capability to determine the best possible personalized approach for each client. Correspondingly, a 360-degree view solution was needed.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/germany-desktop-2x.png)

Project overview

Andersen's customer is now running a unified 360-degree client view database. Each of the profiles it stores contains a history of interactions, a history of offers, and calculated NPVs for each product and channel. The offers are assigned on a black-box basis, with test and control groups. While participating in this initiative, our team wasn't aware of the exact logic applied to assigning test and control groups or offers. This situation is quite typical because the offers can be managed by different departments, teams, and systems – both manually and on the basis of A/B tests.

When working on the project, we focused on:

- Resolving the problems with the customer's legacy data warehouse (DWH). The issue was that it had complex ETL pipelines and was very expensive as it was based on Oracle Exadata. The customer wanted to decrease costs and add business intelligence;

- Fine-tuning the data synchronization process between client apps, channels, the data warehouse, and record systems;

- Working on the customer's data lake.

Requirements analysis and market research

To start with, our specialists carefully reviewed and analyzed the customer’s current state of affairs and their tech capabilities against the backdrop of their requirements. Andersen's team also did extensive market research. After that, we outlined the main idea to improve the customer’s system; particularly, we decided to migrate it to a data lakehouse based on open-source technologies.

Project progress

Challenges

The logic used for test and control assignments was unknown to us. More precisely, there was no guarantee that those assignments were not proposed at random. Therefore, any performance evaluation of the customer’s model had to be based solely on historical data. This data might have reflected arbitrary biases.

In an ideal case, we would evaluate every model version via randomized experiments. However, such testing is generally expensive and risky from the customer experience standpoint. Therefore, we had to develop an offline evaluation methodology that would reduce the number of online trials and mitigate the risk of adopting catastrophic policies.

Solution

Andersen's team generated a procedure for bias control and correction to address potential biases in the historical data. We built a core model focused on the product and channel balance. Its mission was to estimate the probability of sales, resulting from different types of offers. This further helped determine the optimal next-best offer strategy for each client, product, and channel.

Based on probability scores (i.e. the prescriptive part of the next best offer model), we implemented the offer type selection logic. Andersen's specialists developed an evaluation procedure to assess the quality of the model using the bias-corrected data.

Project results

As a result of our work, a single source of correct information allowed the customer to calculate and improve a definitive loan-to-value. All that data is accessible within one central repository, which reduces the time and cost needed to integrate it.

- 40% higher conversion rates owing to personalized offers;

- 87% customer satisfaction score (CSAT) for selected products;

- 23% increase in read rate and сlick-through rate.

Business analysis aspects

The contribution of our analysts consisted of:

- Searching for the significant attributes required to identify target groups of clients;

- Synchronizing the data flow for smooth flow computing;

- Testing hypotheses with historical data;

- Developing a model of the multi-stage data processing for the purpose of minimal system load.

Sequence diagram

Project results

- Documentation and development of "as is" and "to be" models of data exchange;

- Elaboration of a flexible system of indicators and reports to analyze the results of the solution;

- Integration of the calibration system feature into the software.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us