A Solution to Manage Personal Finance

About the client

The customer was a group of managers from a large online bank. Their goal was to build a unique mobile banking application and a convenient platform for digital investments within a single solution. Its functionality was expected to include payments, transfers, travel accounts, reports, etc.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/germany-desktop-2x.png)

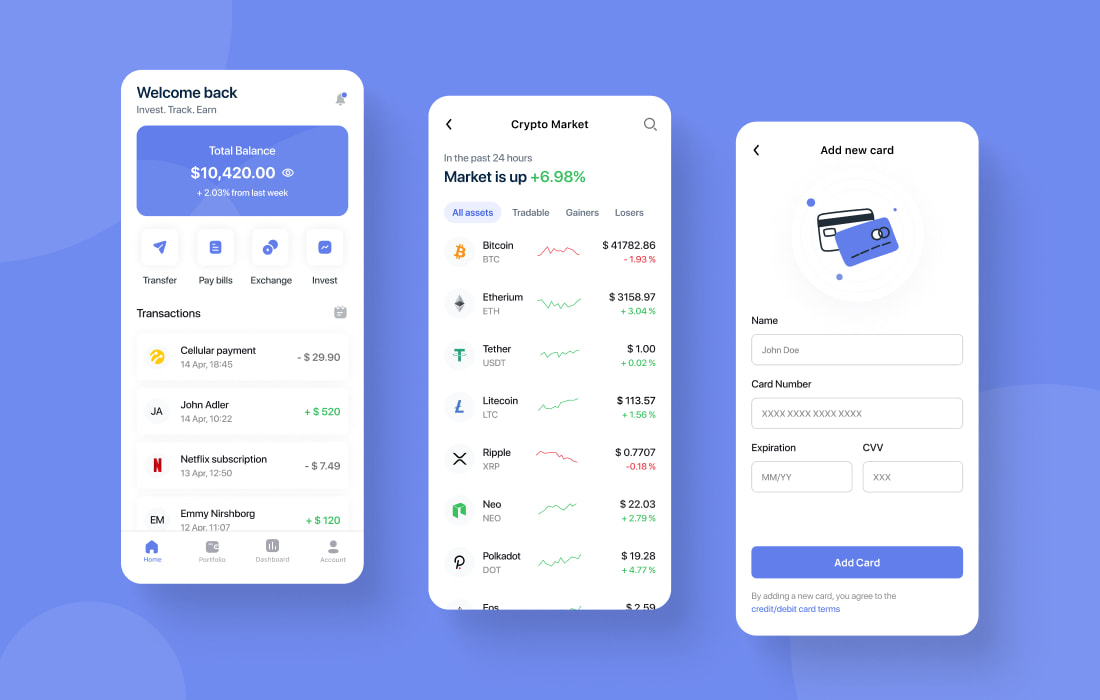

An All-in-One Personal Finance Tool

Project overview

The project was launched in 2019 in Europe by managers of the largest online bank in the region. Its goal was to build a unique mobile banking application and a convenient platform for digital investments within a single solution. Its functionality was expected to include payments, money transfers, multi-currency travel accounts, spending reports, and segregated accounts, as well as the capability to invest in international stocks, ETFs, and crypto assets. As a result, the process of personal finance management was to become simpler, more flexible, and 100% transparent.

The resulting platform interacts with licensed online banking software of one of Germany’s largest banks, through which it gets access to Visa. The platform offers two types of accounts – Standard and Prime.

Just like in other FinTech startups, the solution allows its users to perform any desirable transaction via the app. Cards can be added to Google Pay and Apple Pay. Users store their personal funds in dozens of different currencies. If clients pay by card abroad, they benefit from a more favorable exchange rate than the one offered by other banks. Fractional stock trading is also available on the platform. Users can invest in stocks and ETFs with no commission applied. In addition, they can also buy, store, and exchange cryptocurrencies using the app thanks to the partnership between the customer and CM Equity AG.

Finally, users can create additional accounts called pockets. Clients send money from one account to another and add users to their pockets. Each pocket has its IBAN. Hence users can pay certain types of bills via a specifically designated pocket.

A coherent and effective process of continuous development and support was established to build a digital platform and its component. Each module was developed and supported by a dedicated team.

App functionality

What Andersen has built can be defined as a digital platform that includes such components as:

- Digital banking capabilities (savings, transfers, payments, smart spending, etc.);

- Investments (purchase and sale of securities);

- Crypto options (purchase and sale of digital assets).

These components are tightly integrated with each other and are available via a single mobile application interface for both iOS and Android.

Pockets and multicurrency options

Users can open up to 15 subaccounts free of charge with individual and SEPA-compliant IBANs. In addition, one can add 40 (Standard) or 100 (Prime) currencies to their accounts and, for instance, create a special digital fund (for example, a 'travel pocket' for a trip).

Cashback

This option enables users to earn money when paying for goods or services. Cashback can also be invested in stocks of private companies and generate passive income.

Investments

The platform allows users to invest small sums of money – starting from ¢1 – in stocks with no fees applied (so-called 'fractional stocks'), ETFs, or cryptocurrencies. One can also invest in SPACs and precious metals.

Transfers

Users can transfer money to others directly via the app, with no need to enter IBAN – all one needs is the recipient's phone number. This service is free and available throughout the entire Eurozone; thus, it can be used while traveling.

Reports

Both income and spending are recorded in detail and grouped in the app. This feature provides you with an accurate overview of your finance and cashback returns via real-time push notifications. You can also define a limit for certain spending categories (such as entertainment or online shopping) and get informed when you get close to it.

Super Deals

When someone opens an account in the app at the invitation of a user, the latter gets 8-week access to Super Deals. These are exclusive offers amounting to up to €50 in cashback.

Account replenishment

With the replenishment functionality, others can add up to €1,000 to your accounts free of charge and in real-time. The following replenishment means are available: Google Pay, Apple Pay, and SEPA transfers, as well as credit or debit cards. One can monthly transfer up to €200 (Standard) or €1,000 (Prime) to your account via lightning transfers.

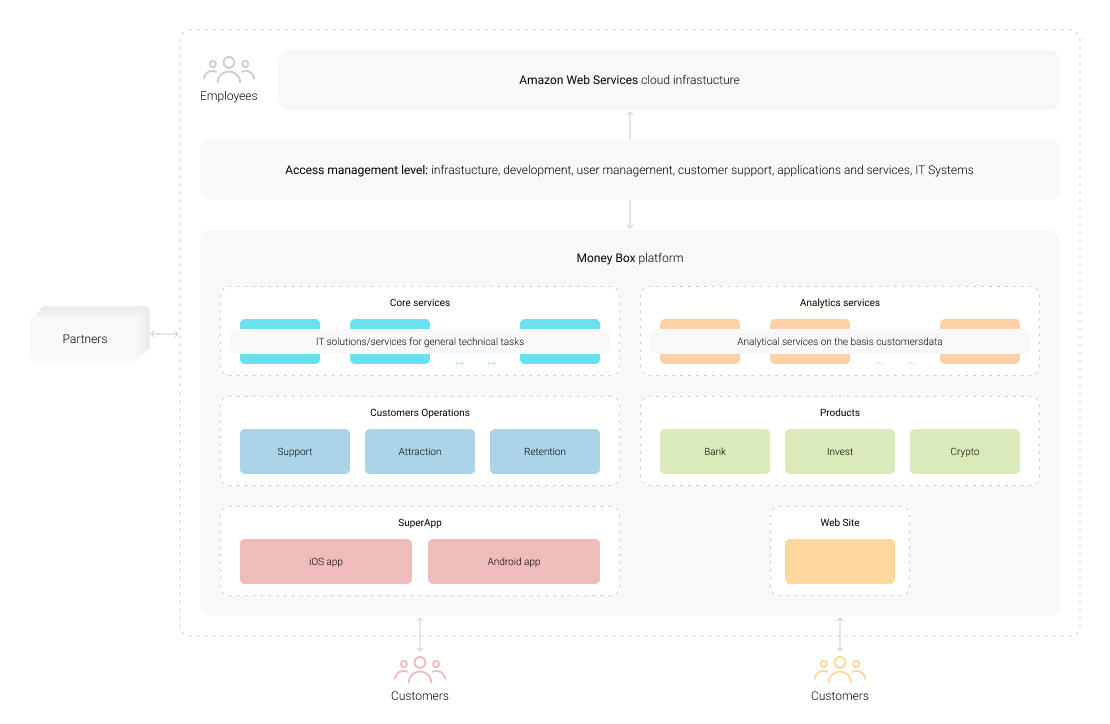

The platform is based on the Amazon distributed cloud infrastructure and built using a microservice architecture enabled by Kubernetes and other compatible technologies. Such an approach makes it possible to ensure high performance in terms of:

- productivity;

- flexibility and speed;

- reliability;

- security;

- scalability.

The available products are united and provided in groups of functional services that are responsible for:

- delivery of products and features to end-users;

- development;

- improvement and upgrades;

- customer support.

Project results

- Successfully developed a unique mobile banking application and platform for digital investments;

- Achieved a fivefold growth in client base, with a total of 500,000 clients in one year;

- Generated 25 times more revenue and raised €200 million in investments;

- Comprehensive functionality for personal finance management, including payments, money transfers, multi-currency travel accounts, spending reports, and segregated accounts;

- Ability to invest in international stocks, ETFs, and crypto assets;

- Platform's integration with licensed online banking software and partnership with CM Equity AG allows for seamless purchase, storage, and exchange of cryptocurrencies;

- Continued development and support will ensure its success in the future.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us