The customer chose to protect their confidential information

A Financial and Mobile Banking Application for SMEs

About the client

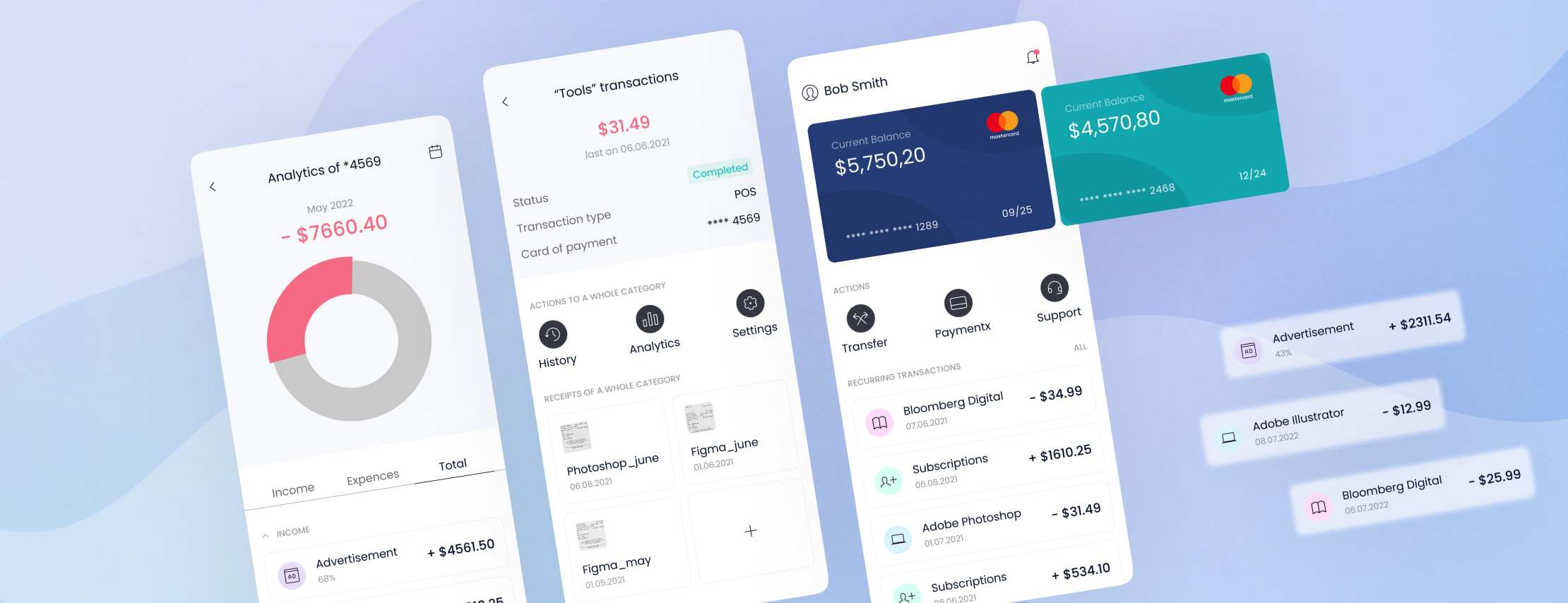

The customer was a Gulf-based organization belonging to the FinTech domain. They asked us to engineer a cross-platform mobile solution that would be used by small and medium-sized businesses as an alternative to traditional finance apps. The result of development is a first-in-class tool "designed by entrepreneurs for entrepreneurs." In this capacity, it is a perfect mobile banking example of next-gen digital products.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/uae-desktop-2x.png)

About the project

Andersen was entrusted with developing a financial and mobile banking solution for SMEs in the Gulf region. The customer, a Gulf-based company working in the FinTech space, wanted to obtain a cross-platform app tailored to provide SMEs with a range of services and tools on a convenient and transparent subscription basis.

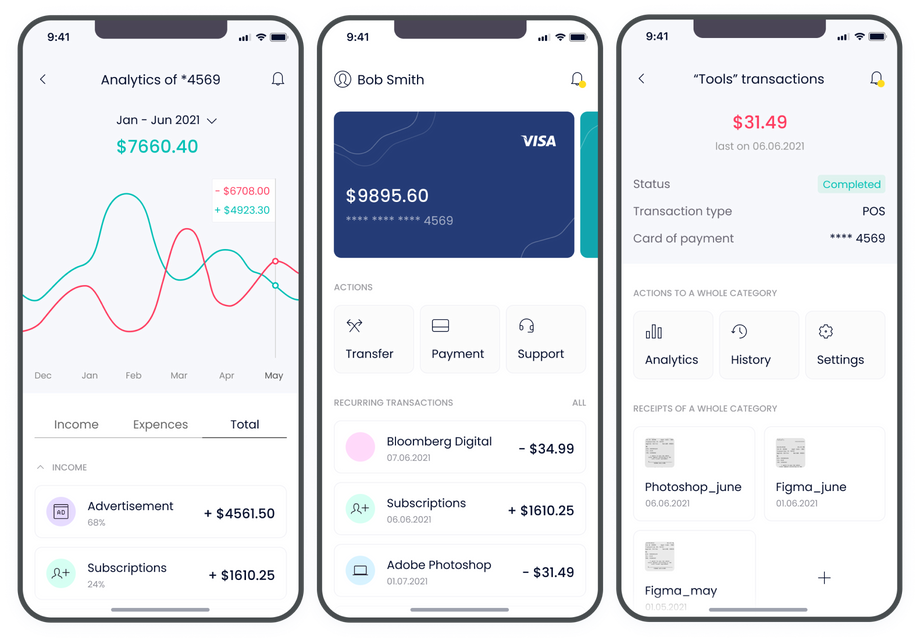

Andersen's FinTech experts have successfully crafted an innovative SME mobile banking app using Flutter. This framework was selected as our front-end platform due to its ability to save time and resources, great potential for quick MVP engineering activities, and visually appealing design. The resulting app streamlines financial management and operations for small businesses and includes such features as income and expense management, transaction categorization, invoice generation, online incorporation services, instant notifications, and online payments.

Integrated with the VISA payment processing system and using the customer's IBAN, the project was completed within four months. The resulting app received high praise from the company's CTO, who appreciated our dedication and high-quality work. The solution stands as a unique and pioneering solution in the Gulf region.

App functionality

- Income and expense management;

- Categorization of transactions and expenses;

- Generation and tracking of invoices;

- Online incorporation services via mobile devices;

- Instant notifications after transactions;

- Online payments.

Solution

Andersen’s dedicated team has successfully built a path-breaking cross-platform mobile app and tailored it to the Gulf market. We chose Flutter as the best possible front-end option for this software product for two reasons. First, Flutter gives the possibility to save time and resources, enabling our team to build and launch the MVP in the shortest possible time. Second, the visual design it offers is similar to native apps. The resulting solution uses the customer's IBAN and is integrated with Visa Payments Processing via its API.

Project results

- A unique and pioneering solution for SMEs has been successfully introduced in the Gulf region;

- The app provides a range of financial services and tools on a convenient subscription basis, streamlining financial management and operations for small businesses;

- The use of Flutter as the front-end platform has resulted in a visually appealing design and efficient development process;

- The app is integrated with state authorities, KYC providers, Visa Payments Processing, etc.

- The development of the app was completed by our team in just four months;

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us