The customer chose to protect their confidential information

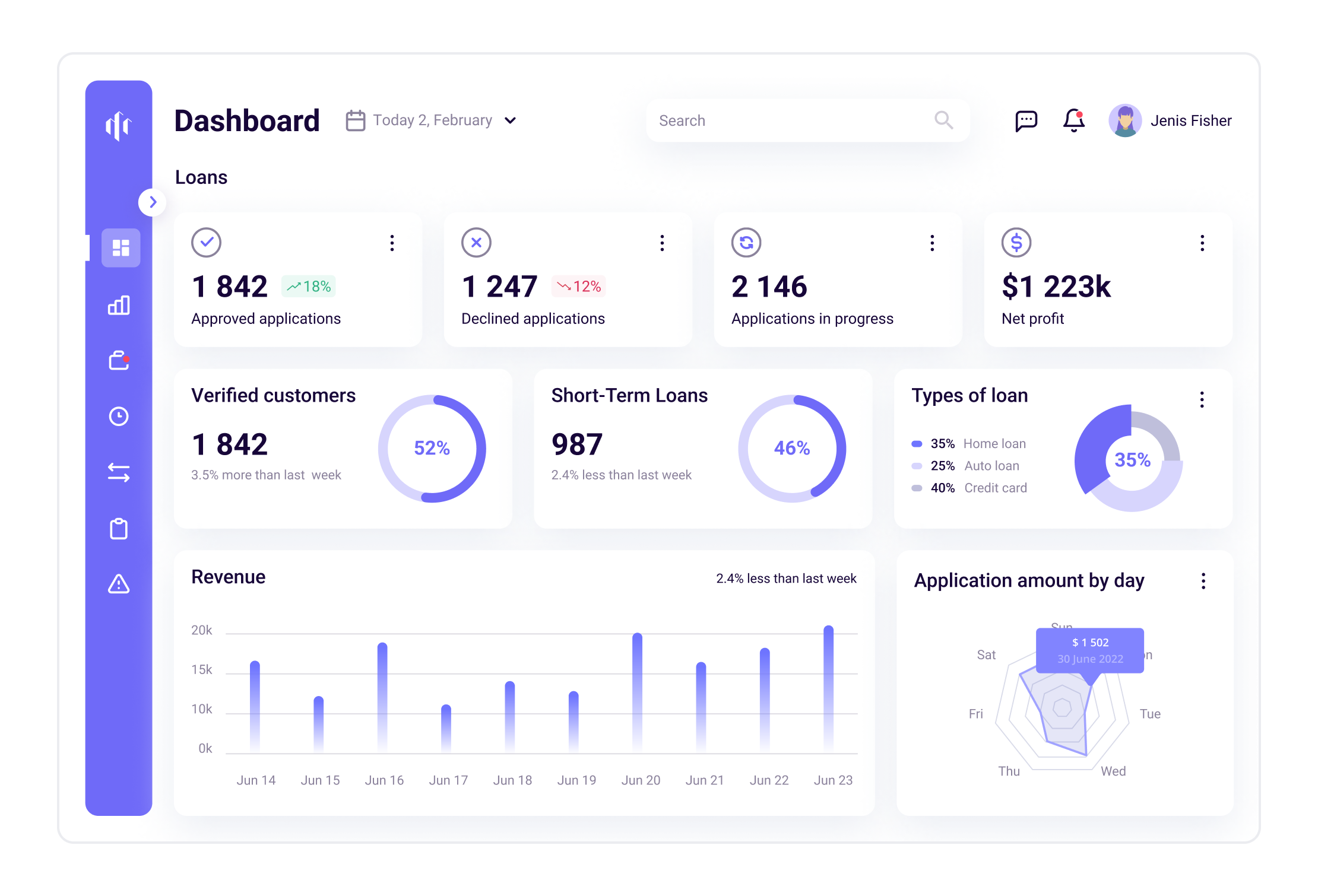

A Finance Solution to Control and Facilitate Loan Issuing

About the client

In this case, we collaborated with a growing European company. They take a strong interest in FinTech in general and the credit industry in particular.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/serbia-desktop-2x.png)

Project overview

This IT project was implemented for one of the largest banking holdings in Eastern Europe. The latter constantly deals with countless processes of preparing credit offers and approving clients' applications for loans. Such processes typically include several key phases, i.e.identity check, credit scoring, product eligibility, conditions and amounts.

Before implementing IT solutions, the onboarding of clients and the application process was manual and inefficient. The banks' employees were deemed to input client data, and update system records manually. And the examination of client eligibility criteria and following preparation of terms and conditions were set manually too. Such a lengthy administrative process reduced banks' capabilities significantly.

The credit factory was intended to automate and facilitate this sophisticated and time-consuming decision making process. The retail credit factory functions based on a microservice architecture using a centralized AI-driven platform. Such a technology makes it possible not only to swiftly and effectively respond to client requests but also to forecast them.

As an outcome, the customer is in the right position to promptly generate loan offers that can assuredly be pre-approved in advance.

Tech Approach

The microservice architecture of the credit factory was structured and built on the Camunda bpm engine. Such an engine is a set of libraries, making it possible to execute predefined processes.

This approach enabled us to create a flexible and scalable architecture, which includes the following advantages:

- A capability to restore the process from the point of any recent tech failure; on top of that, such a capability is available right 'from the box';

- Integration of GUI enables real-time monitoring capabilities;

- A capability to write unit tests focused not only on the logic and integration but also on the process itself.

- The microservices responsible for the credit factory stages were delivered as Java components using the Spring framework and were configured via Spring Boot. As for the components themselves, they rely on their own data sources based on the PostgreSQL DBMS.

- On top of that, the microservices are integrated with external systems via various technologies and protocols, such as REST API, IBM MQ, Apache Kafka.

- Since the credit factory is intended to make decisions within a few minutes, its database is accessed via Spring ORM and optimized to handle fast and high-load data queries. The interaction between the system components is asynchronous and is implemented via Apache Kafka.

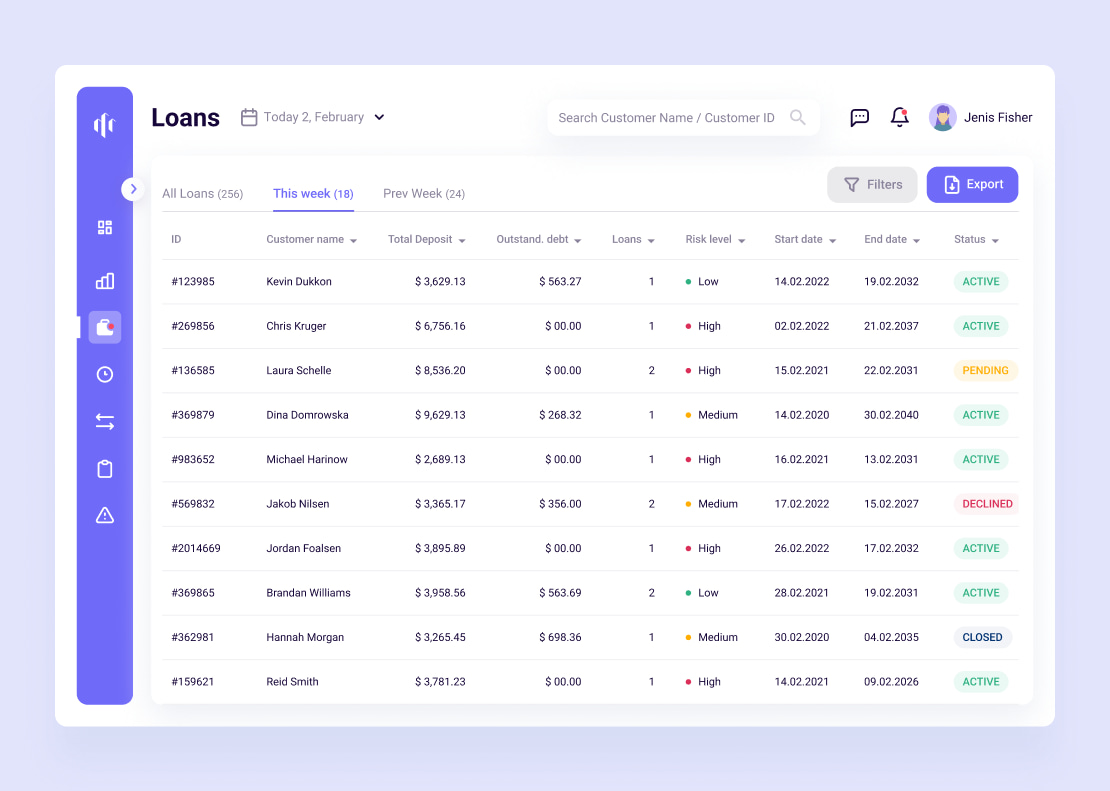

App functionality

The basis for building the credit factory architecture was constituted by statistical models using all information available for assessment. At the first stage of the factory launch, the bank introduced models to assess clients’ credit risk and models to assess their propensity to take up loan products. This credit factory is unique, since those models are processed via queries sent to a centralized platform to execute modes.

The credit factory uses several modules to perform:

- Credit record assessment (main sources include credit bureaus and internal bank data);

- Solvency assessment (salary paid, transactions, and other sorts of internal data);

- Risk level assessment (probability of default);

- Credit limit calculation;

- Selection of a loan product for the client based on propensity models.

- Pricing specifications;

- Reliability assessment;

These statistical models help make credit loan offers even more tailored to clients: borrowers receive pre-approved and necessary loan products at the right moment of time directly from the bank, in a convenient fashion, and via the most optimal service channel.

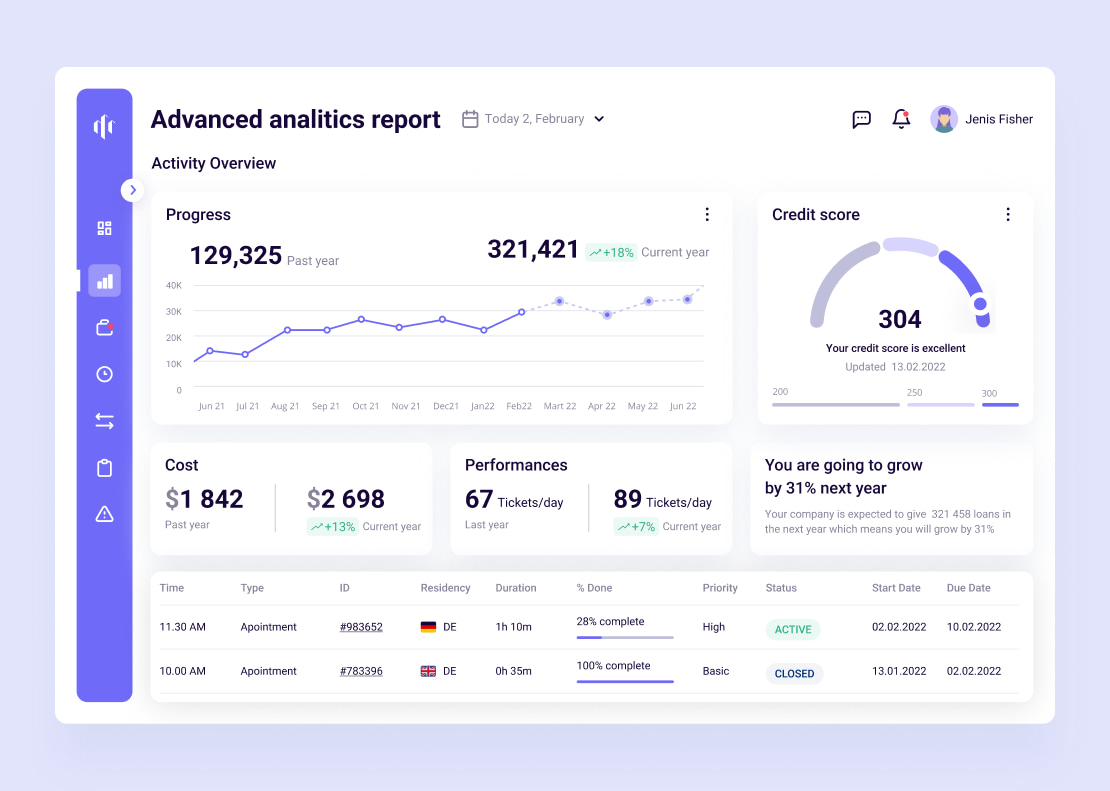

The advanced analytics capabilities developed are directly responsible for selecting particular loan offers. I.e., it is all about the AI-driven platform for applying and managing the models involved in the process. The latter combines the capabilities of innovative modelling and machine-learning methods — NLP, graph analytics, geo-analytics, etc. — based on an entire range of internal and external data at our disposal.

More importantly, those models created via the available algorithms independently learn as they process new data. Thus, they are actively applied and extremely helpful. For example, with these models, it was possible to develop and introduce models to assess the churn rates of different groups of customers and responses to loan products across the entire customer base.

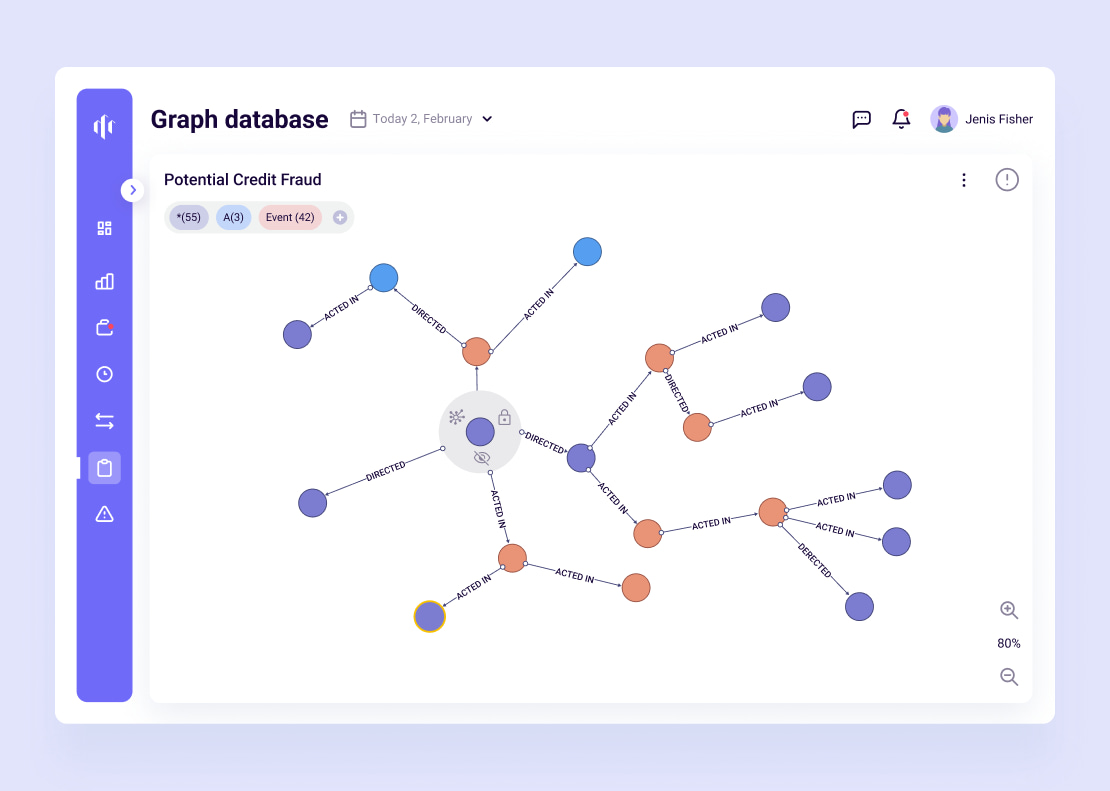

Finally, we successfully integrated graph analytics, relationship analysis, and contradiction techniques into the resulting IT solution to help identify, investigate, and fight credit fraud.

Solution

Processing one-third of the client base used to take up to one month for the customer. With this solution, the process only takes four days. Cash loans and credit cards are now issued based on this new technology. As a result, the customer is in the right position to simplify the client registration process even more and reduce the amount of info requested from them. Finally, the upgraded risk assessment model now provides potential borrowers with exclusively tailored-fit loan offers.

In order to generate precise and structured loan offers, a user applies statistical models to assess credit risks. In addition, the customer now uses models based on external and internal data to evaluate the client's eligibility for a particular loan. It is also noteworthy that, in the course of adopting the solution, a fresh model to assess income and the most suitable loan amount was introduced. Consequently, it is now possible to individually calculate the maximum credit limit for a client.

The solution includes modules for calculating credit scores, decision-making, interacting with external data sources, processing client income, and identifying and assessing potential fraud.

Project results

- The time required to generate pre-approved loan offers has been drastically cut down, streamlining and speeding up the lending process;

- The models created by the available algorithms learn independently from new data, making them actively useful for assessing client churn rates and responses to loan products;

- The integration of graph analytics and relationship analysis into the IT solution helps to identify, investigate, and combat credit fraud.

Capabilities and Features

I. Model execution

The credit factory features a micro-service-based platform to execute models. It allows the customer to provide various clients with a Model-as-a-Service (MaaS), which uses different data processing frameworks: both online with low response time and high data load and in the batch mode that is capable of processing almost any volume of data.

The models responsible for describing the customer’s business process refer to a single platform. That is where the necessary calculations are carried out and results are provided for further use.

The platform itself is connected to the credit factory solution via a set of integration adapters. Thus, it is possible to flexibly configure the credit factory processes and effectively interact with the factory at various stages of application handling.

As the platform functions, all operational data of the system is saved, making it possible to use it further to monitor the system's operation and the model training system.

We plan to supplement the system with a centralized model management system, which would allow the customer to keep a complete and independent register of all the models used and their versions. Hence, the customer will promptly use updated models and even automatically retrain them without any human participation.

Finally, the execution platform is being supplemented with new specialized components, i.e. a graph platform and a geo-platform.

II. Graph platform

The graph platform is used to detect and prevent fraud. It consists of a graph database management system and a user-friendly interface. The DBMS is integrated with Hadoop-based data storage. It is used to build connections between different vertices.

Potential credit fraud can be detected both in real-time and via offline monitoring (detection and investigation of credit fraud, analysis of risk levels for possible credit fraud, etc.).

Credit fraud is identified and investigated via graph analytics, link analysis, and revealed contradictions. The results of any credit fraud investigation can exert influence on processing a loan application and the level where the ultimate decision is made.

III. Geo-platform

The geo-platform functions as a convenient tool to analyze the needs and interests throughout the entire banking process. It acts as a set of geo-layers of various anonymized data. Analyzing it via automatic machine learning (Auto ML) methods make it possible to forecast demand, customer flows, and other factors of importance for decision-making. The geo-platform products are used to assess and foresee the inflow of borrowers as well as for targeted ads.

The data collected within a single geo-grid makes it possible to apply Auto ML methods to facilitate the process of introducing new products in the market. This geo-platform arranges dozens of layers of anonymized data from banking, telecom, and other digital services. Such a module makes it possible to consider a wide range of geographic properties while applying customer assessment models: ranging from the regional level and offices’ location in a particular situation to the residence and employment of an individual client.

IV. Income assessment module

Assessing a client’s solvency is a crucial task when issuing a loan. Unfortunately, most modern banks perform such assessments manually. However, the credit factory makes it possible to apply statistical models for this purpose. As such, they enable end-users to assess a potential client’s income using all available data, including:

- Socio-demographic profiles;

- Information covering previously submitted applications for loans and non-credit products;

- Previous transactions;

- Information on deposits and accounts;

- Payment discipline related to previously issued loans.

Applying this model to the lending process makes it possible to generate full-fledged pre-approved loan offers and determine the optimal credit burden.

Project results

- The speed of client data processing increased by 10 times;

- 20 million pre-approved loan offers within 3-4 days only;

- It takes between 1 and 3 minutes to make almost all the decisions related to retail clients;

- Loan amount limits rose by 15-20% on average, owing to screening models being updated and the income model being introduced;

- The share of clients who do not need to submit any papers covering their income and employment reaches 95%;

- It takes 3 times less time to introduce new loan products to the market;

- The project payback period is below 1.5 years;

- It is possible to forecast the client’s income via applying ML-based methods and models based on them.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us