The customer chose to protect their confidential information

A Finance-Specific Solution to Manage Banking Documents

About the client

Andersen's customer was a major bank from the Netherlands, which serves individuals, companies, and institutions.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/netherlands-desktop-2x.png)

Project overview

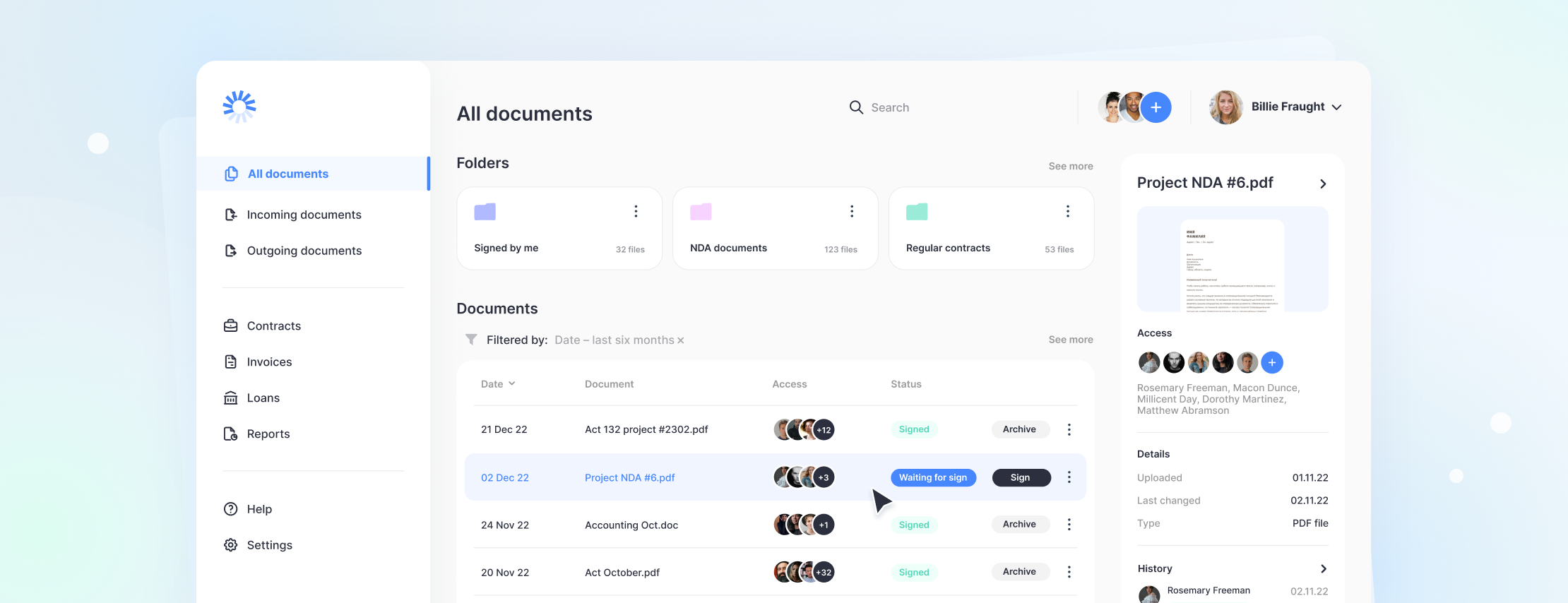

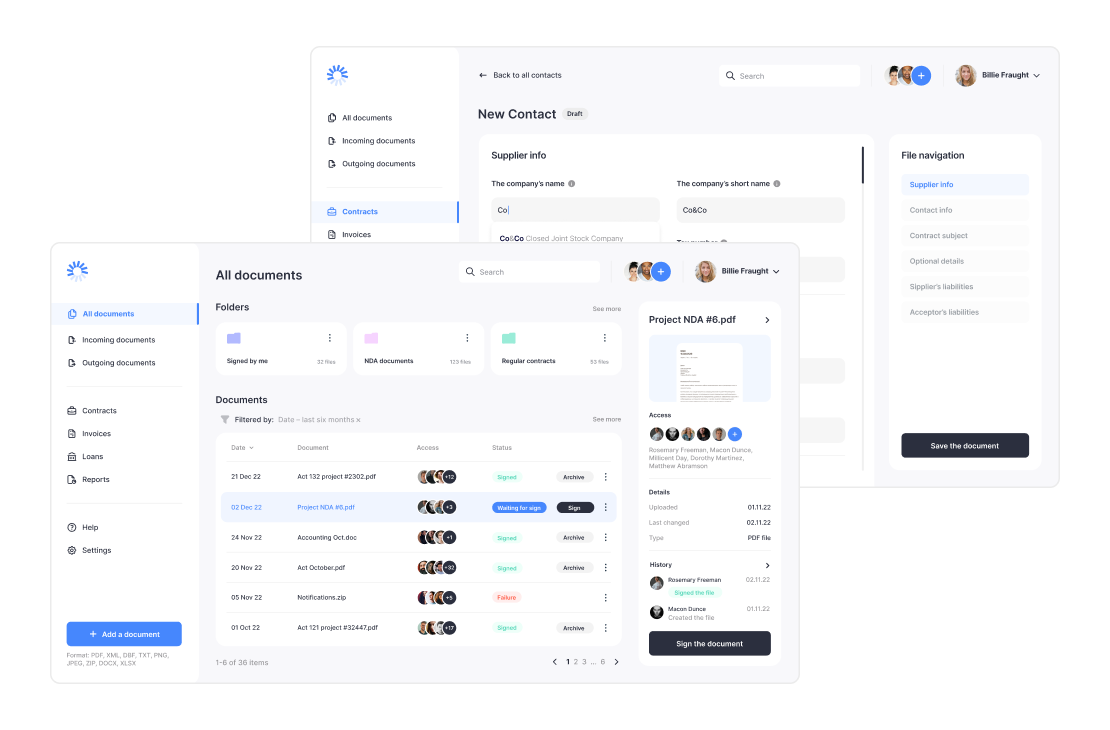

The goal was to build an e-document management system (DMS) for a financial entity. The solution was built as a desktop application integrated with the customer’s desktop CRM system and a range of its web-based apps.

The bank required a tool enabling its employees to create, approve, reject, and sign various bank papers, such as contracts, receipts, etc. That would allow the customer to replace the outdated practices of document circulation.

App functionality

- Digital signature function to approve electronic documents: integration with CryptoPro MyDss and Protectimus and expense management

- User and role management capability to create, update, lock, and disable users and roles

- Two-factor user authentication for security maintenance and risk prevention: integration with Protectimus (SLIM/SMART/SMS/Email)

- Capability to apply for a digital certificate to perform certain actions within the system and get e-signature

- Capability to scan attachments for viruses via the integration with Kasperski anti-virus

- Integration with a Loan Management System to upload approved and signed documents

- Capability to create, update and reject e-docs

Solution

Andersen’s team worked in close contact with the customer. As an outcome, the customer obtained a reliable and secure tool to manage a flexible and confidential e-document flow. Thus, it became possible to replace the old paper-based approach with up-to-date electronic document management. The customer’s workflow processes were standardized for all target countries.

Project results

The Bank’s document management system was totally upgraded while its document circulation procedures became much quicker. As a result, the decision-making process was facilitated and business routines were optimized.

- The resulting solution is a flexible and robust tool for managing electronic documents, replacing outdated paper-based approaches;

- The DMS significantly improved the customer's decision-making processes and document circulation speed;

- The system reduced the loan agreement approval time by 60% and the bank guarantee issuance time by 40%;

- The DMS includes, among other features, a digital signature function for e-document approval, user and role management capabilities, virus scanning for attachments, and two-factor authentication for enhanced security;

- The solution is seamlessly integrated with a loan management system;

- The software standardized workflow processes for all target countries.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us