- FinTech expansion and investment apps

- What retail investors want from investment apps

- Developing investment apps for retail investors: essentials

- Developing investment app for retail investors: process and recommendations

- Conclusion

FinTech in general and investment apps in particular are both on the rise right now. It is no surprise that more and more players that are active in this market are contemplating launching or seriously upgrading their corresponding IT solutions to stay competitive. In this piece, Andersen would like to offer our own corporate perspective on the matter and highlight the functionalities and elements that such an application should offer to stay afloat, win loyal investors, and grow.

FinTech expansion and investment apps

As NASDAQ put it back in March 2021, the recent developments made the retail investor a key player and an important stakeholder in the world of America’s equity trading activities. Indeed, if one takes a closer look at the available statistics, the resulting picture will confirm this statement.

According to Deloitte, in January 2021 alone, the segment of off-exchange trading accounted for over 47% of America’s cumulative volume of equity trading. It was a significant watermark in comparison with the average monthly level of just 41.5% in 2020. More than that, in January 2019, it was as low as 37%.

This breakthrough can be further illustrated by some more figures:

- The number of users of Robinhood, the leading commission-free trading solution, rose from 0.5 million in 2014 to 13 million in 2020. According to a more recent estimate, right now, there may be up to 20 million users.

- There are over 100 million users and accounts associated with the six top online US brokerages.

- Finally, according to the Financial Times, the total number of daily retail investors' interactions with the country’s three main brokerages reached 6 million in 2020.

The rest of the world is likely to follow suit. Hence it is not an exaggeration to say that having a reliable investment app that is well-adjusted to both web and mobile is a matter of survival for any financial institution interested in retail investors as their target audience.

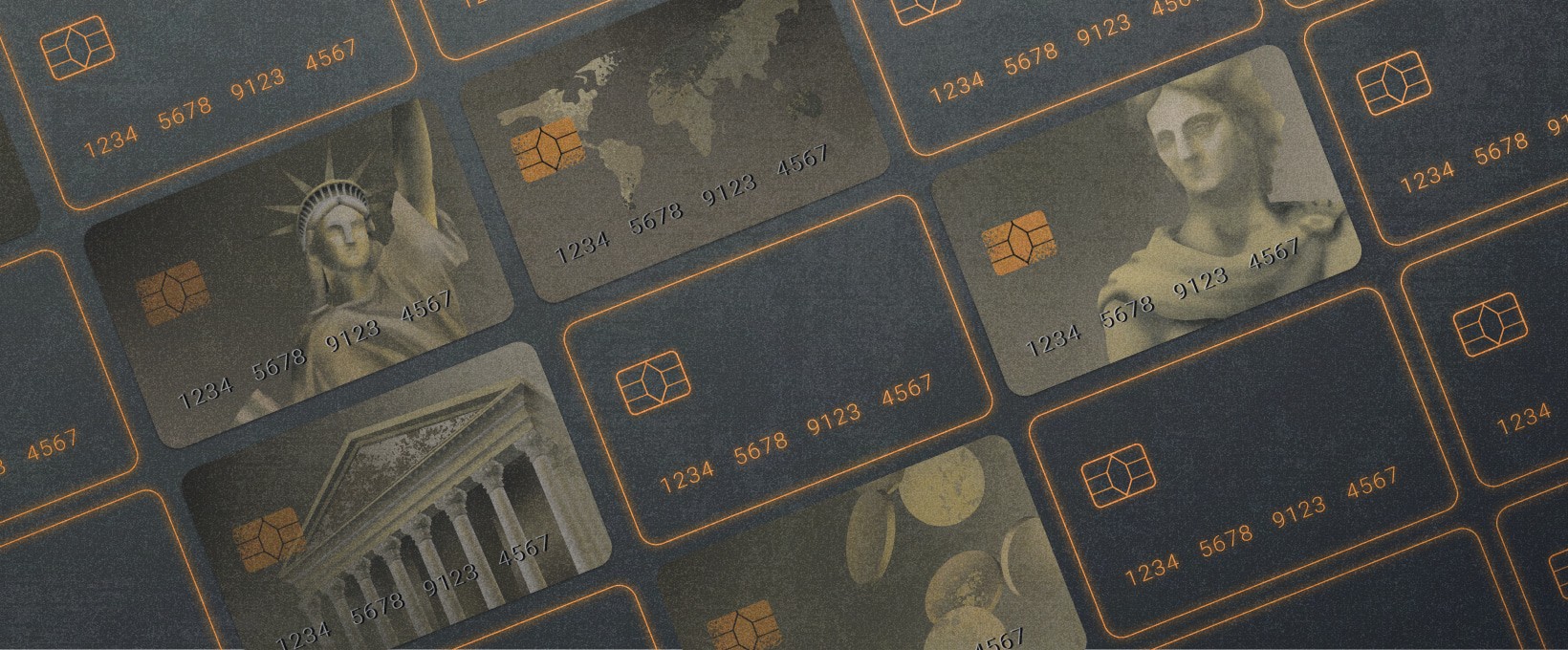

What retail investors want from investment apps

If you are planning to launch a brand new retail investment app or seriously upgrade your existing investment mobile solution, it would be a reasonable step to examine what your future end clients want. Luckily, your IT department or IT outsourcing partners of choice already have some client data to scrutinize.

Among other things, NASDAQ has recently publicized some interesting guidelines.

First of all, most of America’s retail investment app users - 51.5% - are definitely not content with the “insights and research” their brokers provide them with. Hence it is necessary to go beyond the simple execution of trading transactions if you intend to meet this requirement.

Second, the top five preferred "insights and research" are not actually valued by users:

- News is only needed by a little over 34%;

- Alerts, scans and charts by 33%;

- Greater connectivity by less than 10%;

- Pre-and-post-market data by roughly 4%.

Thus, as NASDAQ summarizes, “connectivity, news, and visualization” are the most shared concerns. On top of that, Deloitte stresses that a truly modern and competitive vendor should provide:

- Convenient onboarding capabilities;

- Proper client support and live assistance;

- Sufficient levels of client protection.

Developing investment apps for retail investors: essentials

All the aforementioned criteria are generalized. Hence they should be translated into feasible and practical directions for your IT initiative. Correspondingly, we can describe the following ones:

- Stable client accounts providing your end-users with a technically relevant login process and personal investment space. Such a virtual office needs to simultaneously be created with the best UI/UX practices kept in mind without being overly complicated.

- Money transaction tools coupled with a reliable wallet. These elements should be intuitive and visually comprehensible. On top of that, visualization capabilities — graphs, trading histories, balances, etc. — must be well adapted to portable devices.

- Great connectivity which would encompass a seamless integration with multiple bank accounts, processing equity trading market data feed, conversions with foreign currencies, and effective links with stock exchanges.

- Alerts, hints, and notifications to keep end clients both engaged and instantly updated.

- Advanced and well-thought-out security mechanisms enabling end-users to authorize transactions, apply a 2FA policy, and know that the solution they use is not only 100% compliant with the current legislation but also exceeds it.

- Chatbots and live support when tools driven by AI and ML are not enough. Indeed, the availability of both virtual assistants and live client support services is a must nowadays.

Developing investment app for retail investors: process and recommendations

As with any other complex app, it is recommended to contact an experienced vendor of IT outsourcing services to build such an app. After all, companies of this type have ready-to-use IT talent pools, can offer references and certificates, and are familiar with compliance standards.

Normally, the roadmap of an IT project focused on a retail investment app looks as follows:

- Define your business needs and models so that you can share them with your IT vendor of choice.

- Contact the vendor to specify the tech, usability, and legal requirements and limitations.

- Launch the project in close contact with the vendor, from the core of the solution further to its additional features.

- Test the investment app.

- Stay in touch with the vendor to maintain, support, and upgrade your retail investment app when needed.

Technically, in spite of all the special protocols, APIs, and compliance rules, such a solution can be delivered within a reasonably short space of time. Yet, one still has to have patience since it will definitely take more than a year if you are going to abide by all the applicable regulations (which is a must, beyond any doubt).

Conclusion

If you want to develop a truly innovative retail investment app, feel free to contact an experienced mobile app development services provider to build such an app. By combining our industry-specific expertise in finance with a broad knowledge of the Agile methodology and latest frameworks, we will make sure that the resulting investment app will be capable of functioning as an investment tool, assistant, coach, and personal advisor.