- What DevOps stands for

- Benefits of DevOps for finance

- Conclusion

DevOps has already revolutionized many industries. Here and now, when your business speed is the crucial success factor, being able to quickly introduce your solution and upgrades to the market is a must. No matter how effective and helpful your product might be, if you fail to keep up speed, you are walking on thin ice. That is why each industry, including the most conservative ones, needs the DevOps approach nowadays. Finance is no exception.

What DevOps stands for

DevOps refers to software development combined with IT operations. It serves as a range of practices aimed to minimize the time lag between making a change to the system and placing this change into regular production, with a high level of security and quality ensured. In this capacity, it helps you deliver projects faster and ensure these deliverables match your business needs.

Being oriented on the Agile methodology, DevOps emphasizes the need to generate a business environment that harmoniously directs the development process, design, QA and testing, etc. toward a shared goal. As such, the DevOps Lifecycle can be divided into the following continuous components:

-

Development: it implies planning and coding isolated into short cycles.

-

Integration: this is a core concept of DevOps supposing that code changes supporting fresh functionalities are integrated into the main code more often.

-

Testing: in this case, this means repeatedly and frequently testing code for bugs and errors.

-

Monitoring and feedback: i.e. analysis of changes and improvements introduced together with constant tracking of the way they function.

-

Deployment and operations: these are understood as non-stop processes.

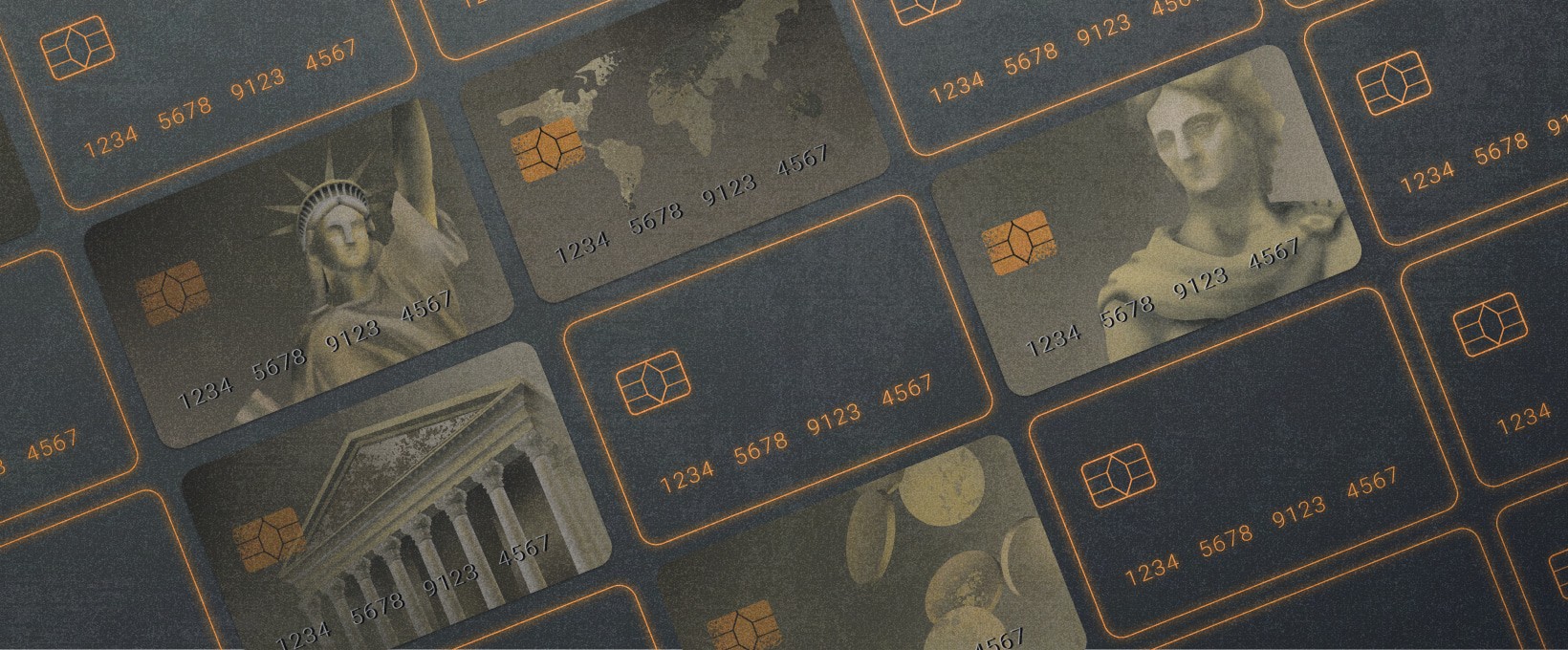

If you think about the applicability of DevOps to such a conservative industry as finance, you might initially feel suspicious. On the one hand, this approach promises never-ending improvements, quick growth, and ultimate success. On the other hand, big money is a very sensitive field. It requires precaution, maximum confidentiality, and foolproof and error-free systems.

At the same time, the facts speak for themselves. The leading financial institutions, such as Capital One and American Express, have not only adopted DevOps - they have achieved a lot. So if you run a finance company, you probably need to take a closer look at this approach as well.

Benefits of DevOps for finance

There are already many success stories associated with the implementation of DevOps in the finance and banking industry. For example, Barclays has facilitated its development process and significantly increased the quality of its code since 2015. What is the reason for this?

Modernization of IT legacy systems

While the very beginning of online banking can be traced back to the early 1980s, the first truly online bank was established in 1994. Ever since that moment, financial institutions have been migrating online. Needless to say, most of their systems were outdated and inadequate by the 2010s. However, a big financial entity can't abandon its legacy tech completely and start from scratch.

That is where DevOps comes to the rescue. Within this framework, one becomes capable of upgrading an outdated system gradually yet continuously.

Greater degree of automation

The essence of DevOps is all about continuous processes. As a result, it gives more space for automating anything capable of being automated. Since it is based on repetitive stages, the entire delivery pipeline can be automated to an unprecedented extent. Thus, financial institutions can leave unnecessary development routines and useless efforts behind to concentrate on driving value to their customers.

Compliance and security

Again, initially, DevOps was seen as a threat to security and compliance. It is no surprise that numerous important industry players were reluctant to adopt it. At the same time, the evidence shows that if you introduce DevOps properly, it will enhance your standing, not weaken it.

How can it be possible?

The key to success is to integrate security into the lifecycle as a whole. As for the most obvious measures to take, they include:

- Storing your source code in a specifically designated version control repository.

- Limiting access rights to system resources to authorized team members only.

- Coding in small chunks so that one can promptly and effortlessly detect code vulnerabilities.

- Applying monitoring services to track open code source portions and alert your staff.

- More thorough testing procedures, including pentest aka ethical hacking.

- Etc.

If your team applies DevOps in this fashion - which is a must in finance - you will facilitate compliance and security, not weaken them.

Shift to another development philosophy

There is never a shortage of complaints when it comes to banking in some developed countries. While some developing markets are astonishing the world with their innovation and tech progress in the finance industry, well-established institutions in the advanced economies keep on going around in a circle. DevOps is one of the means to break this vicious circle and become more agile, flexible, and modern.

Conclusion

Whether you are facing upcoming challenges within a multinational financial giant, trying to boost the performance of your regional bank, or planning to upgrade your microfinance app, DevOps is a promising direction at all these three levels. And Andersen is in the right position to help you adopt and apply it to your business practices.

With Andersen, you can benefit from a comprehensive tech stack, get access to an ever-ready IT talent pool, and deep financial expertise confirmed by multiple projects of different scopes. Beyond any doubt, DevOps with Andersen's team will add great value to your finance software project and pave the way to an improved quality of business.