The customer chose to protect their confidential information

An E-Payment Solution Providing Financial Services

About the client

In this business case, the customer was an e-payment company. The customer's goal in building and maintaining an e-payment ecosystem enabling both organizations and individuals to financially grow and thrive.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/usa-desktop-2x.png)

Project overview

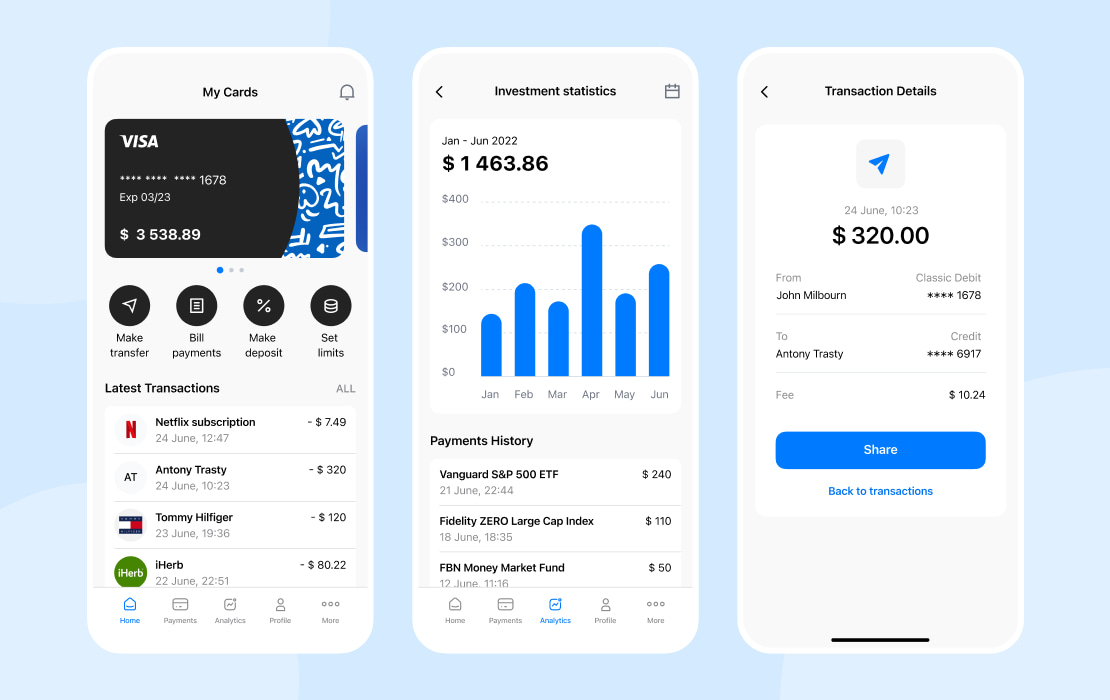

Andersen was contacted by an e-payment customer to improve the way they provided financial services for businesses and individuals. The key goal of the project was to help the customer better carry out its main functions, i.e. circulate money electronically and perform exchange operations.

Solution

The project outcome fully matches the customer’s business goals. Owing to Andersen’s contribution, the e-payment system processes digital transaction receipts better and faster. On top of that, its end-users now can benefit from the capability to make payments in a simpler and safer fashion. Their interaction with the customer was also significantly streamlined and facilitated.

As for the tech aspects of the development process, Andersen used an approach enabling us to work on the Android and iOS apps simultaneously. In addition, the solution was developed as extremely scalable from the outset. It is also important that data is stored in an encrypted form between different sessions. Finally, caching is used to the maximum extent possible. Hence, if certain data has already been received from the server, there will be no need to request it again. Such an approach reduces the number of network requests and web traffic as well as enhances the overall performance of the system.

App functionality

- A complete range of e-banking services made available. They include balance checks, mini statements, fund transfers from cards to accounts, mobile devices, and other cards as well as mobile phone top-ups and bill payments, etc.;

- New “Pay With App” capability added as a fresh checkout option. With it, one can make payments with the app to avoid unnecessary risks and entering one’s card details;

- Optimized handing of transaction receipts including receipt histories;

- Account statements can be delivered by the app via emails, making it possible for end-users to avoid making phone calls or visiting the customer’s branches in person.

- Improved processing of client complaints via a mobile digital channel to increase customer satisfaction rates;

- A capability to easily view, download, and share such documents;

Project results

- The solution's reworked UI/UX, based on comprehensive tests, enabled end-users to identify the functions needed to make payments 30% faster

- The Andersen team treated security issues with great importance. Hence, the most up-to-date security, encryption, and data protection standards were introduced into the solution

- On average, every customer’s employee saves up to 31% of their working time

- The solution was delivered as a white-label one which made it possible to quickly adapt it the needs of 7 large banks

- Client satisfaction rate increased by 17 % on average

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us